Tuesday's Notes of Interest

President Trump lifts most US sanctions on Syria. President’s executive order also reviews Damascus’s designation as state sponsor of terrorism.

Syria rising …

FT: “Today’s actions . . . will end the country’s isolation from the international financial system, setting the stage for global commerce and galvanising investments from its neighbours in the region, as well as from the United States,” said Brad Smith, acting under secretary of the office of terrorism and financial intelligence at the US Treasury department.

https://www.ft.com/content/458a5122-bf22-46fd-9fdd-082e005aed96

Levant24 on X: Syrian Energy Minister held a virtual meeting with his Jordanian counterpart and Qatar Fund for Development to discuss transporting Qatari gas to Syria via Jordan. The project, stalled by the war, is regaining traction amid regional normalization.

The Circuit: Syria raised the minimum public sector wage from $25 to $75 per month, covering civilian and military employees in state-linked entities.

We are looking at drought conditions and water shortages this summer in all the Levant countries. This will have geopolitical repercussions.

Syria Direct: Syrian farmers face worst drought in decades. Syria’s worst drought in decades has wiped out rain-fed crops and diminished yields across the country, devastating farmers and raising the risk of food shortages.

https://syriadirect.org/zero-season-syrian-farmers-face-worst-drought-in-decades/

Reuters: Water crisis forces some Iraqi farmers to abandon their land. Some farmers in Iraq's southern province of Najaf are abandoning their land and livelihoods as a severe water crisis gripping parts of the country has prompted authorities to ban summer farming and rice cultivation.

https://www.reuters.com/video/watch/idRW542726062025RP1/?chan=sports

Will AI increase this trend ?

Charlie Bilello on X: 20% of companies in the S&P 500 have fewer employees today than a decade ago, including McDonald's, General Motors, Procter & Gamble, Bank of America, and Walmart.

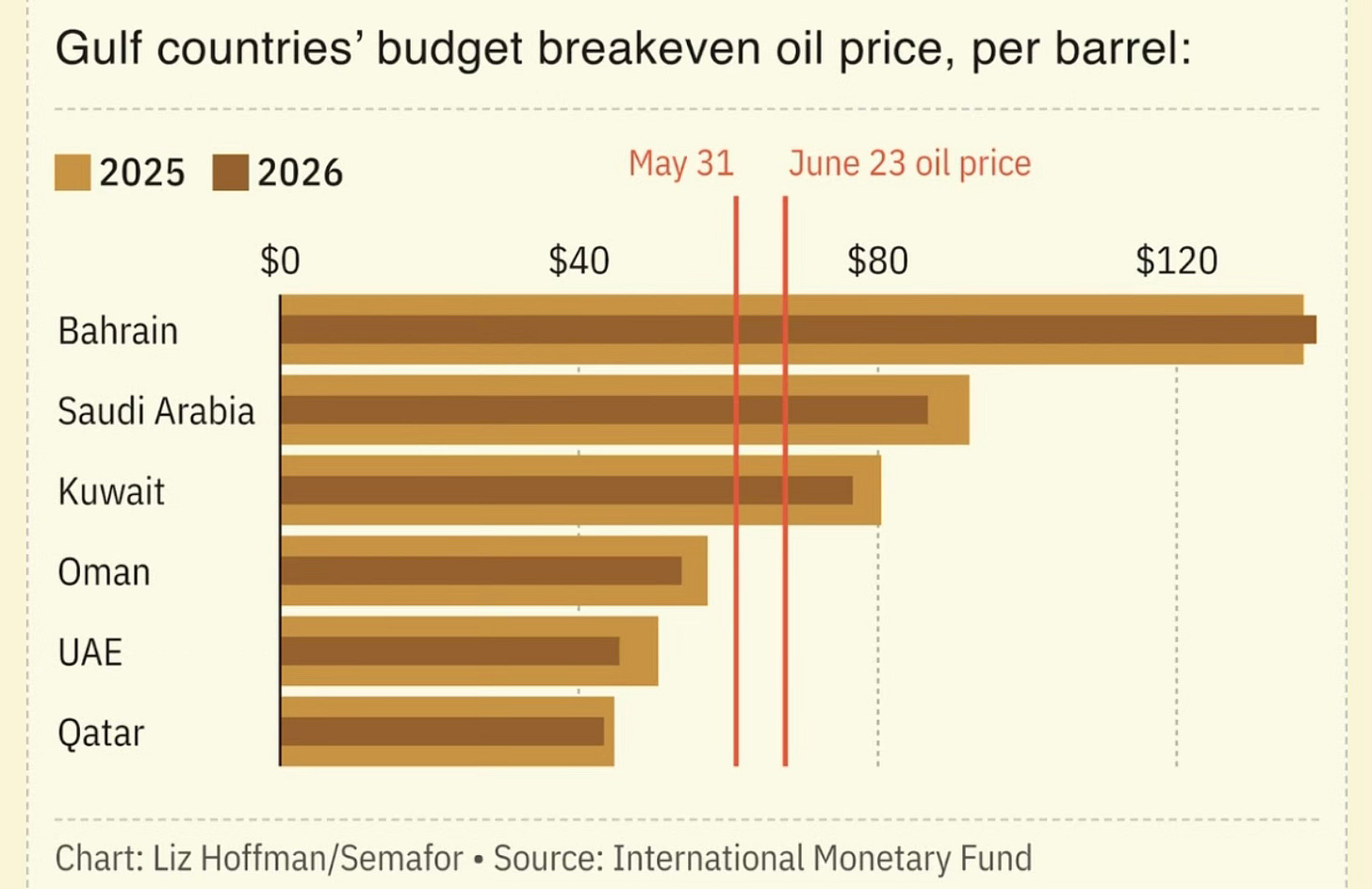

All sorts of debt instruments will continue to be in use by GCC governments to manage finances, including bonds and sukuks …

Semafor:

Saudi’s capital market continues to develop …

Semafor: Already borrowing from global bond investors, Saudi Arabia’s Public Investment Fund said this week it will also start issuing ultra-short-term debt, called commercial paper.

https://www.pif.gov.sa/en/news-and-insights/press-releases/2025/pif-establishes-its-first-commercial-paper-program-further-diversifying-its-funding-sources/?utm_source=semafor

European infrastructure investments will boom …

John Lothian News: DWS chief urges Europe to accept more Chinese and Gulf investment; Comments from Deutsche Bank's asset manager come as Germany gears up for EUR500bn infrastructure blitz

Florian Muller - Financial Times

The chief executive of Deutsche Bank's asset management arm has urged European policymakers to adopt a more pragmatic stance towards investments from China and the Gulf, as Berlin prepares to spend hundreds of billions overhauling its creaking infrastructure. "Just as Donald Trump and his entourage travelled to Doha, Abu Dhabi and Riyadh to raise trillions for America - would German or European leaders do the same?".

/jlne.ws/4neRUlN

Egypt’s massive economic potential …

The Circuit: Egypt has opened 12 oil and gas blocks – five offshore and seven onshore – for foreign investment as part of its latest licensing round to boost hydrocarbon resources.

The Circuit: Valu, an Egyptian retail finance company, began trading on the Egyptian Exchange on Monday after its parent company, EFG Holding, gave 20.5% of its shares to its shareholders, including Amazon.

Solar + battery will be a big part of the world’s energy future …

Reuters: Rapid growth in the installation of batteries is upending power systems across the United States, with battery-deployed electricity volumes scaling new records nearly every month. Steady cost declines combined with rising energy density levels are driving utilities to ramp up battery installations, and battery storage output now often exceeds all other power sources for key periods in certain electricity markets.

https://www.reuters.com/markets/commodities/us-power-sector-battery-storage-momentum-keeps-charging-2025-06-24/?taid=685abdb98217380001326203&utm_campaign=trueAnthem:+Trending+Content&utm_medium=trueAnthem&utm_source=twitter

Well done ! More liquidity for Qatar listed firms.

FT: Qatar’s sovereign wealth fund has struck a deal with Canadian asset manager Fiera Capital to set up a fund that will invest $200mn in Qatari stocks. QIA was anchoring the $200mn Fiera Qatar Equity Fund with both cash and shares listed on the Qatar Stock Exchange.

https://www.ft.com/content/75de30b1-2f50-4ac2-ab61-49649df4f8c8

An interesting take on a geography focused ETF …

Tracy Shuchart (𝒞𝒽𝒾 ) on X: BlackRock launches Texas ETF as state draws investor interest. BlackRock said on Tuesday it had launched a Texas-focused exchange-traded fund, as the state gains traction as a rising hub of economic activity in the United States. The Lone Star State's low taxes, business-friendly policies and growing tech and energy sectors have attracted investors and asset managers looking to tap into its long-term growth potential. BlackRock said iShares Texas Equity ETF will invest in companies headquartered in the state. (Reuters)

Really !

John Lothian News: Jane Street Boss Says He Was Duped Into Funding AK-47s for Coup

Ava Benny-Morrison and Sridhar Natarajan - Bloomberg

The indictment reads like a cinematic plot: A Harvard Fellow and another activist allegedly wanted to buy AK-47s, Stinger missiles and grenades to topple South Sudan's government. What they lacked was enough cash. Now, Jane Street co-founder Robert Granieri concedes he put up the money - saying he was duped into funding the alleged coup plot. The role played by the wealthy recluse behind a Wall Street trading powerhouse emerges from the US prosecution of Peter Ajak, the Harvard Fellow who was accused last year of scheming to install himself atop the East African nation.

/jlne.ws/4kUUkEB

Cyber security issues will only multiply …

FT: The US House of Representatives has warned staff members not to use Meta’s messaging platform WhatsApp due to privacy concerns. The decision was taken due to “a lack of transparency in how [WhatsApp] protects user data, absence of stored data encryption, and potential security risks involved with its use”.

https://www.ft.com/content/95e21b39-08af-47cc-8a9c-5e4f34508003

Oman rising …

Zawya: Oman Investment Authority (OIA) added 13 new investment funds to its private equity and venture capital portfolio in 2024. The investments—spanning digital infrastructure, artificial intelligence, fintech, clean energy, and other strategically vital industries—were executed through the Future Generations Fund (FGF).

https://www.zawya.com/en/economy/gcc/oman-oia-expands-private-equity-footprint-with-13-new-investments-in-2024-p53gtth0

Digital currencies are here to say …

John Lothian News: UAE fund buys $100 million of Trump's World Liberty tokens

Tom Wilson - Reuters

A United Arab Emirates-based fund has bought $100 million worth of digital tokens issued by World Liberty Financial, the crypto venture of U.S. President Donald Trump's family, becoming its largest publicly known investor. Aqua 1 Foundation said in a statement on Thursday its purchase of the tokens, known as $WLFI, sought to speed up the creation of a "blockchain-powered financial ecosystem" with stablecoins and tokenised traditional assets at its heart.

/jlne.ws/3T9q7pk

Central bankers need to stop wrecking their economies will high interest rates and come to terms with the fact that new levels of inflation, given what is happening in the world, will not return to 2% any time soon …

NYT DealBook: Jay Powell pushes back on pressure to cut rates sooner. The Fed chair told House lawmakers yesterday that he most likely wanted to see more data on the inflationary effects of Trump’s tariffs before lowering borrowing costs. That was a notable divergence from calls by two Trump-appointed Fed governors, Christopher Waller and Michelle Bowman, who suggested they would support cutting rates as soon as next month.

Kuwait rising …

The Circuit: The Trolley convenience store chain is planning an IPO in a rarity for the Kuwaiti market amid the steady stream of new share sales coming out of Gulf neighbors Saudi Arabia and the UAE. Founded in 2010 and now operating 170 stores throughout Kuwait, Trolley is being advised by EFG Hermes and National Investments Co. on the IPO, which could take place as early as this year, Bloomberg reports.

Trolley’s planned listing comes as Kuwait’s stock exchange has risen 14% since the end of last year, outperforming Dubai’s 8.9% gain and increases in other Gulf markets. Only two companies have gone public in Kuwait over the past three years. Beyout Investment Group raised about $146 million in 2024, while Ali Alghanim Sons Automotive came out with $322 million in 2022.

Part of humanity’s future challenges ….

John Lothian News: AI Willing to Kill Humans to Avoid Being Shut Down, Report Finds

Jasmine Laws - Newsweek

A new study by Anthropic, an artificial intelligence (AI) research company, shows that the technology would be willing to kill humans in order to prevent itself from being replaced. The rapid advancement and development of AI has sparked some growing concern about the long-term safety of the technology, as well as over the threat it poses to employment. While anxiety about AI has been long been focused on whether the technology could take over jobs, with a 2025 Pew Research study finding 52 percent of employees were nervous about the future of their job, this study now reveals another potential threat of AI-that it could choose to end human life if faced with the risk of replacement.

/jlne.ws/45FVpeT

Algeria’s big energy potential …

The Circuit: Algeria's Sonatrach signed an agreement with U.S.-based Hecate Renewable Energy and steelmaker Tosyali Algerie to develop a green hydrogen project for steel production, starting with feasibility studies.

Spending on FinTech in MENA will increase …

John Lothian News: Global AML/KYC Spending Seen Rising 12.3% to $2.9 Billion in 2025

Press Release via Traders Magazine

London and New York, June 24, 2025 - Global spend on Anti-Money Laundering (AML)/ Know-Your-Customer (KYC) data & services is projected to total a record $2.9 billion in 2025, according to a new research report published today by Burton Taylor Consulting.

/jlne.ws/3GgyWe7

Turkey is an economic giant …

The Circuit: Turkish Airlines, aiming to nearly double its fleet to 800 aircraft by 2033, is exploring strategic acquisitions to boost connectivity across key European and Asian markets.

Using capital markets to predict outcomes of all sorts of events …

John Lothian News: Prediction Market Kalshi Hits $2 Billion Valuation in New Funding Round; The $185 million round will help the trading startup integrate with more brokers, CEO says

Alexander Osipovich - The Wall Street Journal

Kalshi, a startup prediction market that became a popular way to bet on the November election, said Wednesday that it had been valued at $2 billion in a new funding round, a vote of confidence in its business of facilitating wagers on future events. New York-based Kalshi-which offers a variety of yes-or-no contracts allowing users to bet on topics ranging from hurricanes to the National Basketball Association finals to the Oscars-said it had raised $185 million from investors led by Paradigm, a venture-capital firm best known for its crypto investments. The round values Kalshi at $2 billion, cementing its status as a "unicorn," with a valuation in the billions.

/jlne.ws/4ngCBJH

Needless to say, some countries in MENA holds massive investment potential should geopolitical conditions improve …

Semafor: “If we do get to a serious ceasefire, which I think is not impossible at this time, what is the big investment opportunity in the Middle East? It could be Iran.” Admiral James Stavridis, the former Supreme Allied Commander of NATO and now vice-chair at Carlyle, told Semafor’s Liz Hoffman he sees a “two-in-three” chance of a substantive end to hostilities in which Iran’s abandonment of its nuclear program could usher in an economic reopening of the country.

“There’s a lot of chaotic movement,” he said, noting that sanctions would be slow in changing. “But if you follow the geopolitical trends to a happy ending, which is not impossible, Iran becomes a very interesting investment opportunity. It could look like the reconstruction of the Korean peninsula after the end of the Korean War.”

UAE in UK …

Semafor: Abu Dhabi is taking on a piece of British media. A subsidiary of Multiply Group has signed a deal with the UK’s Wildstone to manage and operate more than 5,000 digital billboards in London.

https://www.zawya.com/en/press-release/companies-news/multiply-media-group-enters-uk-market-with-wildstone-partnership-accelerating-global-expansion-c4k0myli?utm_source=semafor

Fiber-optic cables are part of tomorrow’s infrastructure …

John Lothian News: AT&T Bets Big on Fiber-Optic Lines in Fight for Internet Traffic

Kelcee Griffis and Lisa Abramowicz - Bloomberg

AT&T Inc. executives made the case for giving up on copper landlines and investing in fiber-optic cable. "It has the fastest speed," ... "It has the lowest cost to maintain relative to your traditional copper, which is what we were upgrading." The Dallas-based telecom giant, whose roots go back to the earliest days of the telephone, has been pushing customers to give up their copper lines, which cost the company $6 billion annually to maintain. AT&T is laying fiber-optic cable which can handle more traffic, including an expected boom from a new generation of data-heavy artificial intelligence tools.

/jlne.ws/443csqb

1MDB is not over yet …

FT: Standard Chartered hit with $2.7bn lawsuit over 1MDB scandal. Liquidators still trying to recoup billions of dollars siphoned from Malaysia’s sovereign wealth fund and then laundered.

https://www.ft.com/content/01991f70-5ea1-4b48-8b7f-dc72d6163dcd?fbclid=IwY2xjawLQYcBleHRuA2FlbQIxMABicmlkETFocUxJVmtWbndPeHF6UUlIAR5v0UrW9XuT8dI4f84zlPpwMTALjY-Q8p5oZmm8oLAUI8WNnpGz1N1iGMaeCw_aem_WcJrnVF1rpiZglNqcM04KA

All the best

Majd