Saturday's Notes of Interest

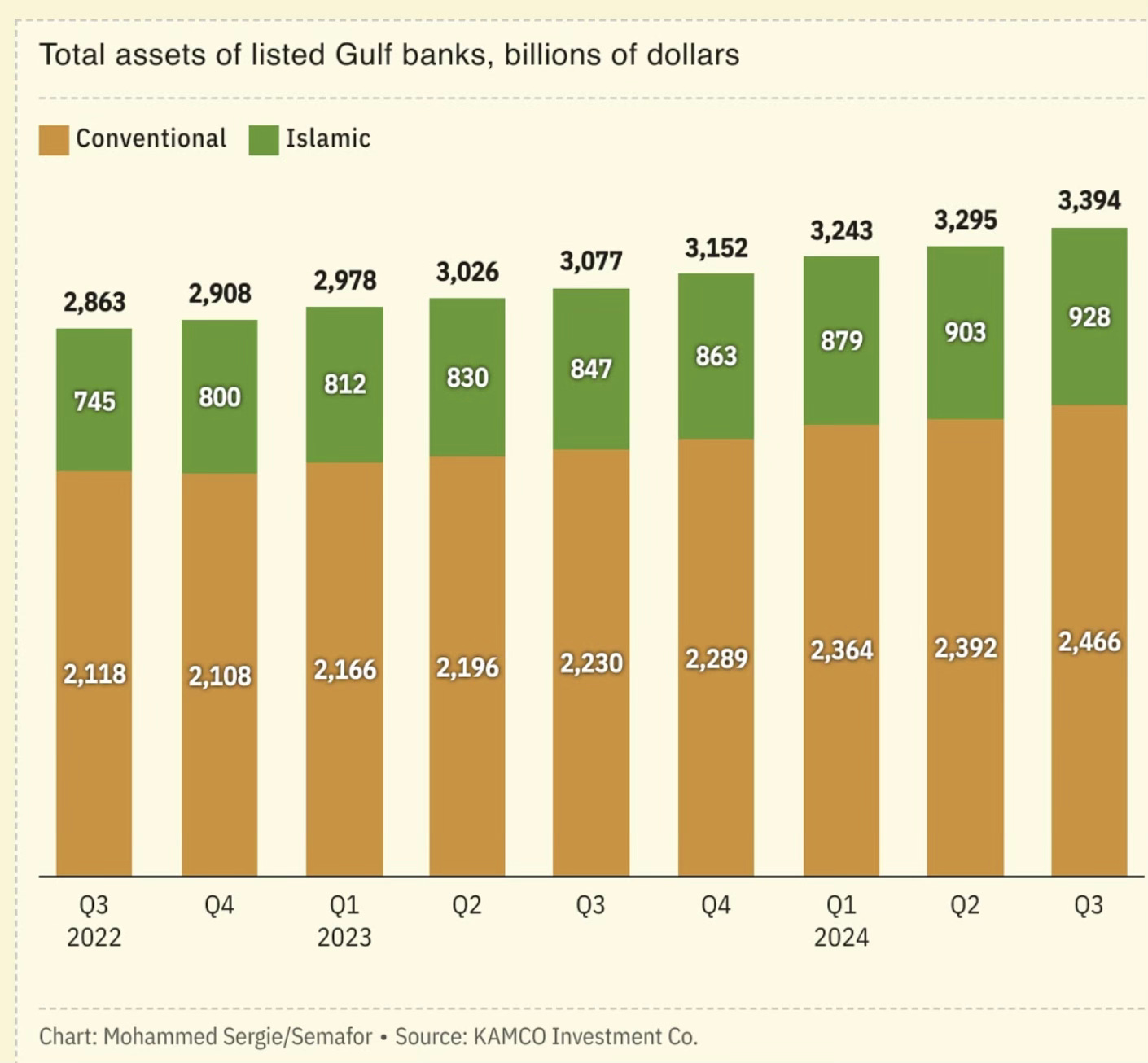

Publicly-listed banks in the Gulf recorded their fastest credit growth in nine quarters, reflecting strong economic activity despite lower oil prices

MENA’s banking sector is ripe for consolidation …

SEMAFOR: Publicly-listed banks in the Gulf recorded their fastest credit growth in nine quarters, reflecting strong economic activity despite lower oil prices. Loans grew by 10.1% in the third quarter, driven by non-oil sector expansion and implementation of long-term development projects, according to KAMCO Investment Co., a Kuwait-based asset manager. Saudi Arabia led the region in credit growth, followed by Qatar and Bahrain, while UAE banks maintained the lowest loan-to-deposit ratio. The rapid pace of lending could strain Saudi banks, forcing them to seek external funding to continue financing domestic projects, KAMCO said.

Arab News: Eleven banks in Saudi Arabia have seen their long-term deposit and senior unsecured ratings upgraded by Moody’s thanks to a strong operating environment. The ratings agency also attributed the decision – which affects institutions including Saudi National Bank, Al Rajhi Bank, Riyad Bank – to the higher capacity of the Kingdom’s government to support the banks in case of need.

https://www.arabnews.com/node/2581163/business-economy

A country’s capital market is part of its competitive advantage …

John Lothian News: FCC Responds to Chinese Attack on Telecom Firms With New Rules; Telecoms required to secure networks against intruders; Rules would require annual certification of risk plans

Kelcee Griffis - Bloomberg

The US Federal Communications Commission proposed a set of rules Thursday that mandates carriers take steps to protect their networks against cybersecurity threats in the wake of revelations that Chinese hackers have likely been embedded in US communications infrastructure for months - with no end in sight. Carriers should be required to "secure their networks from unlawful access or interception of communications," according to the agency, a step the FCC declined to take three decades ago after Congress passed a law to make it easier for law enforcement to access the networks.

/jlne.ws/4glFxQL

Africa rising …

John Lothian News: Africans Demand a Bigger Share of Their Natural Resources Wealth; It's not just military juntas resorting to "resource nationalism." Democracies like Botswana, Senegal and Zambia are demanding better deals, too.

Justice Malala - Bloomberg

If you thought the detention and subsequent release of Resolute Mining Ltd.'s chief executive by the government of Mali two weeks ago was a one-off, you would have been wrong. Last week, as Resolute paid the second, $50 million tranche (the first was $80 million) of a $160 million settlement to the west African country's military junta, Canadian mining giant Barrick Gold Corp. announced that four of its employees in the country had also been detained. Mali claims Barrick owes $500 million in back taxes while the company says it has already made an $85 million payment of an undisclosed sum. (Mali had demanded $380 million from Resolute in new tax assessments.)

/jlne.ws/3VmOvW4

The global competition for minerals …

International Intrigue: Norway is pausing its plans to allow deep-sea mining within its waters, after its Socialist Left Party threatened to tank the government’s budget. Norway became the first country in the world to greenlight commercial deep-sea mining earlier this year as a way to boost the supply of critical elements for the green transition, but it’s triggered criticism from environmental groups.

DealBook: China bans sales of some minerals to the United States. Beijing said a number of materials that are used to make advanced semiconductors and could be used in military applications could no longer be exported to the country. The curbs were announced a day after Washington announced broader restrictions on sales of advanced chips to China.

GCC economies continue to impress …

AGBI: GCC growth to surge to 4.2% in 2025-26 says World Bank, but will remain subdued at 1.6 percent in 2024, as the Omani and Kuwaiti economies contract.

https://www.agbi.com/economy/2024/12/gcc-growth-to-surge-to-4-2-in-2025-26-says-world-bank/?mc_cid=dffb72713f&mc_eid=becab343ef

Advanced economies are suffering labor shortages …

International Intrigue: South Korea has rejected the city of Seoul’s proposal to hire foreign bus drivers in response to a severe local shortage. The proposal, which would’ve allowed drivers to stay for up to five years, got rejected over concerns about worker qualifications and language proficiency.

DW News: Despite recent reforms to labor migration law, Germany is still facing a severe shortage of skilled workers. A new study has argued that this gap will have to be filled by immigrants. According to the study, commissioned by the Bertelsmann Foundation, the size of the German workforce could drop by 10% by 2040 without an influx of around 288,000 skilled international workers per year.

Germany is facing a big demographic shift with baby boomers leaving the labor market. Susanne Schultz, a migration expert at the foundation, argues that immigration can compensate for this, but with labor migration currently lagging below required levels, barriers need to be removed and conditions for immigrants improved.

Germany's labor migration laws were reformed in 2023 to make it easier and more attractive for qualified foreign workers to take up positions in Germany. Releasing its new study, however, the Bertelsmann Foundation said those foreign workers wouldn't come "without a more welcoming culture throughout local authorities and businesses."

Food security in MENA …

The Circuit: Abu Dhabi’s sovereign fund will work with Finnforel, an aquaculture technology company headquartered in Finland, to explore the feasibility of a land-based fish farming facility with a capacity of 3,000 tons per year in the UAE.

What incentives for private lenders to do so ?

gfma: World Bank Chief Economist has called on private lenders to participate in debt forgiveness for the poorest countries as interest payments have surged to a record $34.6 billion in 2023, diverting funds from essential services. The World Bank's International Debt Report highlights that private lenders have withdrawn more in service payments than they have provided in new financing, exacerbating the strain on these nations.

John Lothian News: World Bank Raises Record $100 Billion for Aid to Poorest Nations; Bank chief Banga meets goal of setting record fundraising; Two thirds of IDA lending over past decade has gone to Africa

Eric Martin - Bloomberg

The World Bank received pledges to deploy a record of $100 billion via its unit focused on low-interest loans and grants to the poorest nations. The total figure to fund its International Development Association, whose resources must be replenished every few years, builds on pledges from donor countries announced this week totaling $24 billion, the bank said in a statement.

/jlne.ws/4giqB5U

Abu Dhabi diversifying its energy portfolio …

The Circuit: Masdar, the UAE’s renewable energy company, acquired 70% of Terna Energy, a company that holds the largest and most diversified portfolio in Greece, in a $3.4 billion deal.

Managing geopolitical risks is on top of everyone’s agenda …

International Intrigue: US-based tech giant Meta (Instagram, WhatsApp, Facebook) is planning a massive $10B underwater cable circling the globe, in hopes that sole ownership will help it manage geopolitical risks. Meta hasn’t released details, though there’s speculation the cable may terminate in India to take advantage of the country’s lower-cost data centres.

Cellular towers have become an infrastructure investment asset class …

IFC: IFC has anchored a $1.2 billion dual tranche bond issuance—its biggest ever mobilization for a single bond deal—for IHS Holding Limited (NYSE:IHS) (“IHS Towers”) to support digital connectivity for millions of people in emerging markets in Africa, Latin America, and the Middle East. IHS Towers, one of the world’s largest independent communications infrastructure providers, builds towers, supports the deployment of mobile network operator equipment, and provides fiber connectivity for its customers.

https://www.ifc.org/en/pressroom/2024/ifc-invests-in-ihs-holding-limited-bond-to-support-digital-connectivity-in-emerging-markets

How can having an industrial policy endanger a country’s economy ?

Devex Invested: Industrial policy's rebirth could endanger emerging economies, warns EBRD. State intervention is soaring in sub-Saharan African nations bidding to join the European Bank for Reconstruction and Development — but that brings "significant risks," the bank fears.

https://www.devex.com/news/industrial-policy-s-rebirth-could-endanger-emerging-economies-warns-ebrd-108842?access_key=a66f2968f992dacba6eb4c1b95887940323b1fea&utm_source=nl_invested&utm_medium=email&utm_term=article&utm_content=cta&mkt_tok=Njg1LUtCTC03NjUAAAGXLDknweXt2Mwu_du-NYEF2OBciwpubDhqSFinuJe27hBVh2_RcYR5J89_QdP5Rivn0P4ogpxo1sKIkrsxw8NsUCf-ekKDiXUQR3yiKHen2Yqb9A

MENA’s solar energy potential is massive …

John Lothian News: Saudi Arabia signs solar deals with France's TotalEnergies. Saudi Arabia signed agreements for solar energy projects with foreign partners during the Saudi-French Investment Forum attended by French President Emmanuel Macron on Tuesday in Riyadh. An agreement was signed with French oil major TotalEnergies (TTEF.PA), opens new tab and Al Jumeih Energy and Water for the Rabigh 2 solar power plant.

/jlne.ws/3ZxGtvM

Climate change devastating insurance companies …

John Lothian News: Insurance losses from natural catastrophes set to top $135bn; Two-thirds of global losses were in the US after two devastating hurricanes

Josephine Cumbo - Financial Times

Insurance losses from natural catastrophes, such as floods and hurricanes, are on track to exceed $135bn this year, prompting calls from the world's biggest insurers for more action to tackle climate change. Two-thirds of global losses were in the US, where two hurricanes devastated Florida in September and October, according to a new report by Swiss Re.

/jlne.ws/3OKddvy

Food security in MENA …

John Lothian News: Saudi Poultry Giant Alwatania Is Said to Explore Sale of Company

Christine Burke, Dinesh Nair and Kateryna Kadabashy - Bloomberg

Alwatania, the largest poultry producer in the Middle East, is exploring a sale of the company, people familiar with the matter said, as Saudi Arabia's push for food self-sufficiency makes the industry more attractive. Alwatania has appointed BSF Capital as its adviser for a potential deal, according to the people, who asked not to be identified because the information is not public. A transaction may fetch as much as 2 billion riyals ($532 million), one of the people said.

/jlne.ws/3ZzH1RN

The global fertiliser industry …

John Lothian News: Sellers of Toxic Fertilizer Ask Congress: Protect Us From Lawsuits; The fertilizer, made from sewage sludge, can be laced with "forever chemicals." A company controlled by Goldman Sachs helps lead the lobbying.

Hiroko Tabuchi - The New York Times

For decades, a little-known company now owned by a Goldman Sachs fund has been making millions of dollars from the unlikely dregs of American life: sewage sludge. The company, Synagro, sells farmers treated sludge from factories and homes to use as fertilizer. But that fertilizer, also known as biosolids, can contain harmful "forever chemicals" known as PFAS linked to serious health problems including cancer and birth defects.

/jlne.ws/3BoPWfC

Arab capital markets coming of age …

Arab News: Arab stock markets experienced a boost in trading values in October, with a monthly increase of 16.35 percent, according to the latest report by the Arab Monetary Fund. The AMF’s monthly bulletin showed that the total trading values soared to $97.1 billion, up from $83.5 billion in September. This surge came despite a slight overall dip of 0.57 percent in market capitalization, which ended the month at $4.27 trillion. The gains were not universal, however, as 10 stock exchanges recorded increases in trading value, while four saw declines.

https://www.arabnews.com/node/2581286/business-economy

MENA e-payments are growing with leaps and bounds …

John Lothian News: 2 new e-payment methods launching in mid-2025 as Singapore phases out corporate cheques

Claire Huang - Asia One

Users of cheques will have two new electronic payment methods from mid-2025 as part of Singapore's move to gradually phase out corporate cheques. The two methods will allow deferred payments or post-dated transactions - a key feature of cheques. A post-dated cheque is one that is written with a future date indicated on it and used by businesses in payments.

/jlne.ws/4f50lv1

MENA’s space industry taking off …

Semafor: Oman will make history on Dec. 4 when it becomes the first country in the MENA region to launch an experimental space rocket. The “Duqm-1” will launch from the Etlaq Spaceport in Duqm, which was selected due to its proximity to the equator. The project aims to enhance Oman’s space sector capabilities and is expected to meet the growing demand for satellite launch services. The launch will take place between 8 a.m.-12 p.m. local time and will not be open to the general public, the Oman Observer said.

Well done !

World Bank on X: Kingdom of Saudi Arabia and WorldBank to establish a Global Knowledge Hub in partnership with KSANCC in Riyadh. It aims to drive the global exchange of ideas, experiences, & best practices to tackle the world’s most pressing development challenges.

MENA’s regional electricity market taking shape …

Rai Alyoum: Egypt to export electricity to Syria via Jordan

https://www.raialyoum.com/مصر-تدرس-تصدير-الكهرباء-لسوريا-عبر-الأ/

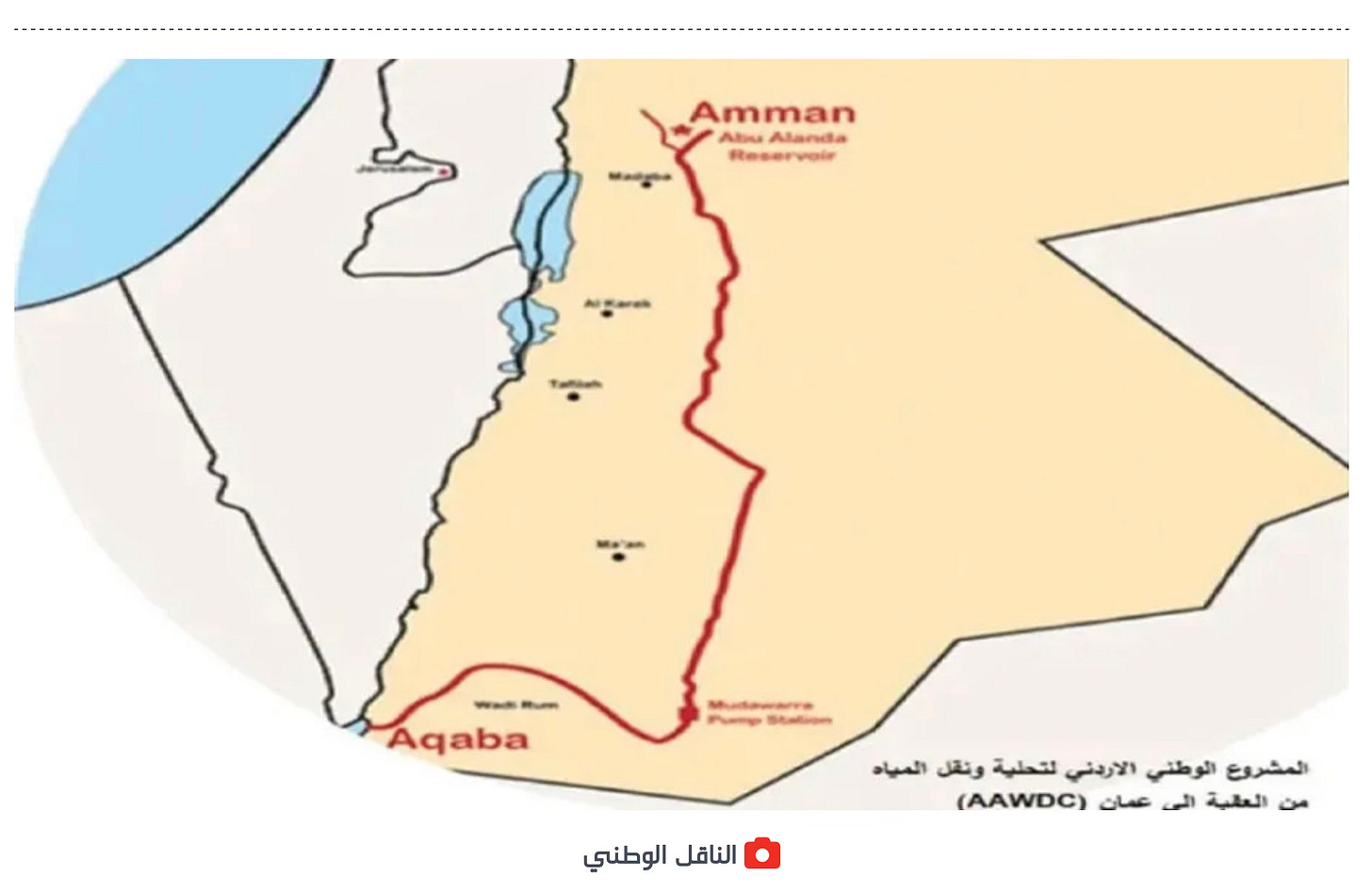

Jordan’s most critical infrastructure project …

Jordan Times: Jordan and Meridiam Suez consortium sign MoU on water carrier project.

https://jordantimes.com/news/local/water-minister-meridiam-suez-consortium-sign-mou-water-carrier-project

Alghad:

Finally, a solution to cash shortages in Libya …

Reuters: Central Bank of Libya contracted British banknote printer De La Rue to print 30 billion dinars ($6.250 billion) in order to "solve the liquidity shortage problem" at the country's commercial banks. The central bank said last Sunday that the liquidity shortage problem would be "gradually solved" as of January in accordance with a plan approved by the board of directors. Despite its oil wealth, Libya has had a liquidity shortage for years, with citizens having to queue outside banks to get cash and salaries since the regime of Muammar Gaddafi was toppled in 2011.

https://www.reuters.com/markets/currencies/libyas-central-bank-print-30-billion-dinars-ease-liquidity-shortage-2024-12-05/

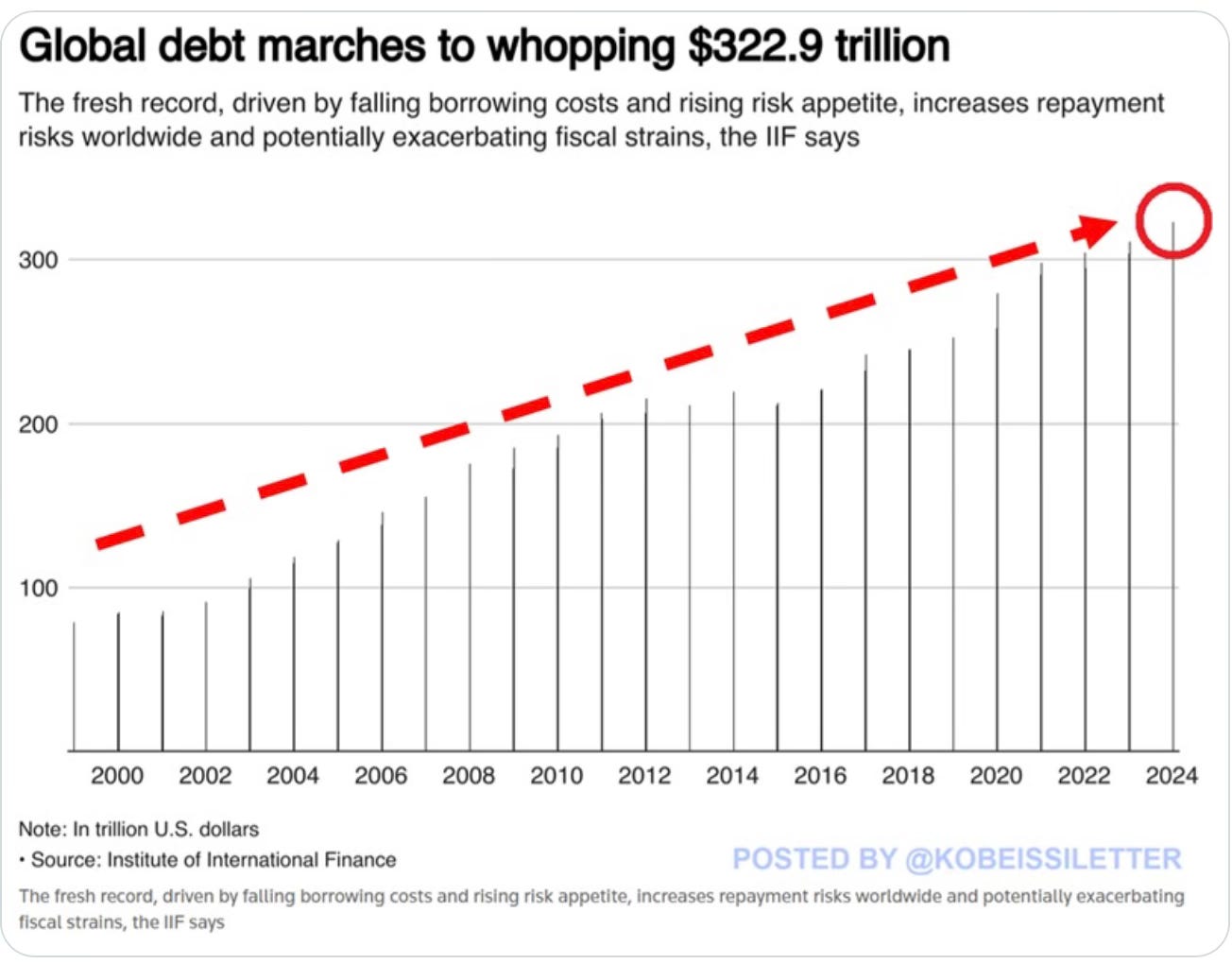

What to do with all this debt ?

The Kobeissi Letter on X: Total world debt officially hit a record $323 trillion in Q3 2024. Over the last 3 quarters, global debt has skyrocketed by $12 TRILLION, according to the Institute of International Finance (IIF). In just two decades, global debt has TRIPLED.

Sukuk listing in Ireland …

AGBI: The Dublin stock exchange – Euronext Dublin – is the world’s largest listing venue for hard currency global sukuk. The Irish capital covered 38 percent of the global total of this kind of Islamic bond at the end of this year’s third quarter – outstripping its two main rivals, the London Stock Exchange (LSE) and Nasdaq Dubai “A large chunk of this comes from the Gulf Cooperation Council countries, too,”. “The GCC is the biggest domicile for issuers.” Ireland also now has the largest overall public Islamic funds market in a Western jurisdiction and the third largest worldwide, with a 17.9 percent share.

https://www.agbi.com/analysis/finance/2024/12/dublin-is-sukuks-best-kept-secret/

Well done !

bt business today: Egypt to list 3 to 4 armed forces companies next week as part of government’s IPO program

https://www.businesstodayegypt.com/Article/1/5620/Egypt-to-list-3-to-4-armed-forces-companies-next

Oil prices will drop …

gfma: Banks are preparing for US oil prices to slip below $60 a barrel by the middle of Donald Trump's new term, a survey showed. West Texas Intermediate is forecast to fall to $58.62 a barrel by 2027. Currently, it has settled at $69.94

Remittances are big business…

MENA’s Digital News: The Central Bank of Egypt (CBE) introduced a new service enabling the instant transfer of remittances from abroad directly into customer accounts at all Egyptian banks, following a successful pilot phase in June.

https://www.zawya.com/en/economy/north-africa/the-central-bank-of-egypt-launches-instant-remittance-transfer-service-akp3bk32

Innovative ways to increase financial inclusion …

MENA’s Digital News: Konnect, Tunisia-based fintech, raised a funding round from Renew Capital, value undisclosed. The startup was founded in 2021 and provides unbanked consumers with a money wallet solution to facilitate financial access.

https://waya.media/tunisian-fintech-konnect-breaking-barriers-one-investment-at-a-time/

MENA Visuals on X: 9000 years old Ain Ghazal statue is the oldest artwork admitted and showed in the Louvre, Paris. Discovered at the archaeological site of Ain Ghazal in Amman, Jordan

All the best

Majd