Saturday's Notes of Interest

July 20, 2024

The Circuit: Jordan’s tourism industry earned revenue of $3.3 billion in the first half of the year, a 4.9% drop from the same period in 2023, which officials attribute to canceled bookings because of the Gaza war.

A big asset manager gets bigger …

John Lothian News: BlackRock Hits $10.6 Trillion Asset Record, Cites ETF Boost

Silla Brush - Bloomberg

BlackRock Inc. hauled in $51 billion of client cash to its long-term investment funds in the second quarter, pushing the world's largest money manager to a record $10.6 trillion of assets. Investors added $83 billion to ETFs and $35 billion to fixed-income overall, New York-based BlackRock said Monday in a statement. /jlne.ws/3LpZtEU

Coupled with the interruptions that happened yesterday that shut down airports and payment systems, guarding the infrastructures of communications has never been more important …

John Lothian News: Damaged Internet Subsea Cables Repaired in Red Sea Amid Militant Attacks on Ships; Vessel owned by UAE-based telco making repairs amid conflict; Fixes to internet cables delayed by geopolitical friction

Olivia Solon and Mohammed Hatem - Bloomberg

Repairs have finally commenced on three subsea telecommunications cables that were damaged in the Red Sea in February, even as Houthi militants escalate their attacks on ships in the area. The AAE-1 cable, a 25,000-kilometer (15,500 miles) fiber optic link between Asia and Europe, was repaired by a ship owned by E-Marine, a subsidiary of Abu Dhabi-based Emirates Telecommunications Group. The cable came online this week, a Yemeni government official said. The same ship, Niwa, remains in Yemeni waters to repair the remaining two cables, Seacom and EIG. /jlne.ws/4bIT9CR

The Middle East needs more ETFs …

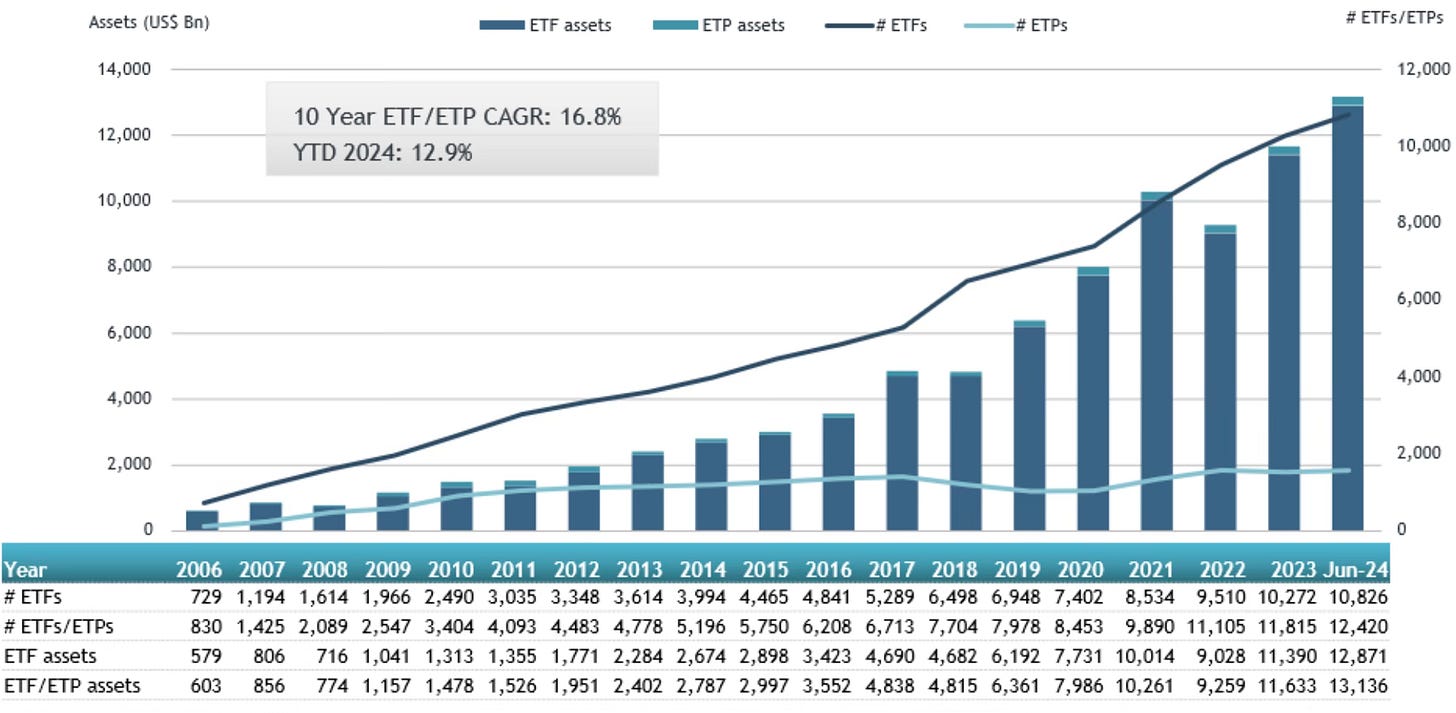

ETFGI on X: Assets invested in the global ETFs industry reached a new record high of US$13.14 trillion at the end of June.

https://etfgi.com/news/press-releases/2024/07/etfgi-reports-assets-invested-global-etfs-industry-reached-new-record

Global Times: Two exchange-traded funds (ETFs) tracking large Saudi companies, including Saudi Aramco, made successful debuts in the Chinese mainland stock market on Tuesday, and their values rose by the daily limit of 10 percent.

https://www.globaltimes.cn/page/202407/1316164.shtml

Catastrophe bonds are on the rise …

John Lothian News: World Bank eyes first 'drought' bond in next 12-18 months

Karin Strohecker and Marc Jones - Reuters

The World Bank is looking to issue its first drought bond in the next 12-18-months and broaden its offering of catastrophe bonds supporting countries suffering devastation from storms and earthquakes, a senior executive at the lender said.

The drought bond would be a new instrument in the multilateral lender's suite of so-called cat bonds - fixed income instruments that pay out to countries in the event of a natural disaster. /jlne.ws/46pH5FT

What to do with all that debt …

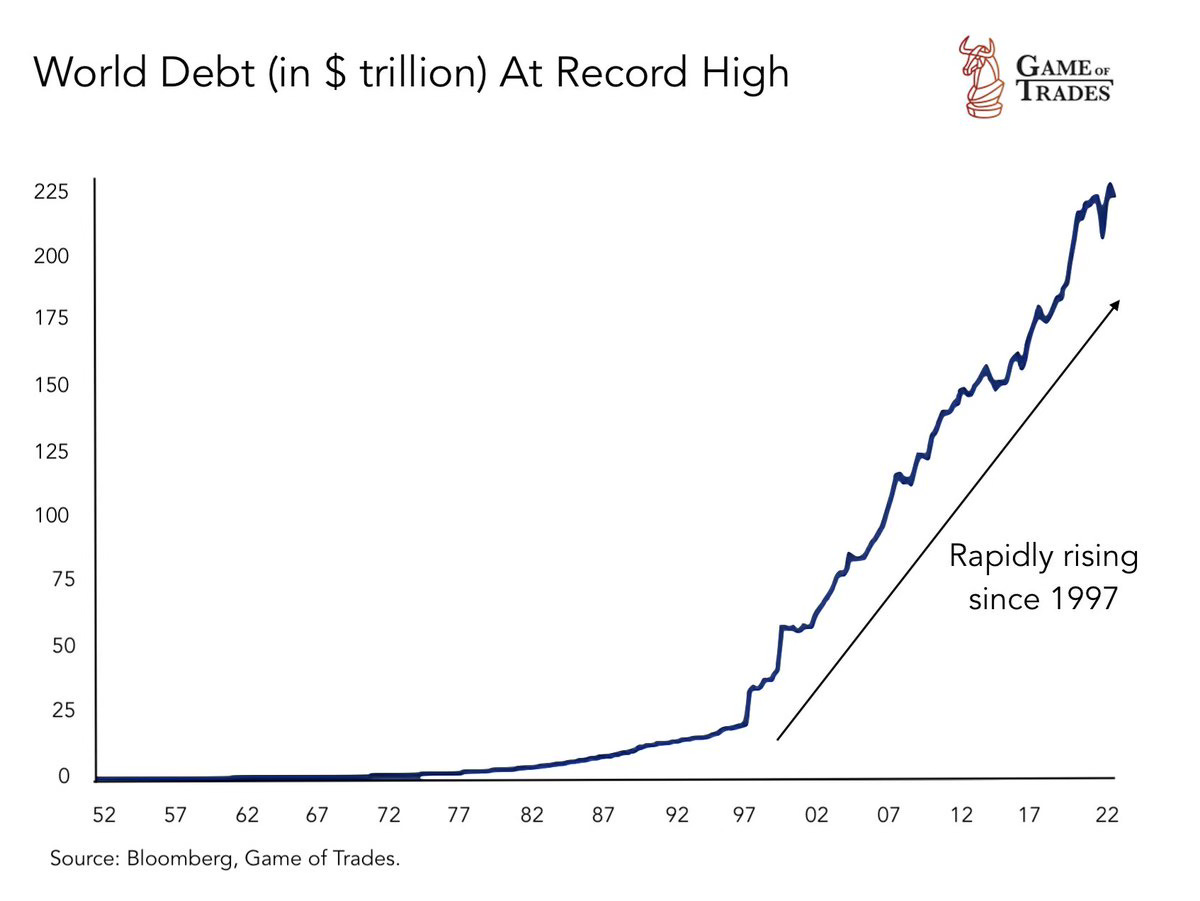

The Spectator Index on X: Global debt has reached $315 trillion, according to data from the Institute of International Finance.

Two different points of view on global debt …

FT: There is no need for investors to panic over government debt. In general, the dynamics in developed countries are unlikely to pose any immediate threat to fiscal credibility.

Games of Trades: World debt has now crossed $300 TRILLION. And is not showing any signs of stopping. This is what playing with fire looks like…

https://www.ft.com/content/3f40c12f-b0d9-43c8-af02-851914ce3ea2?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Education is big business, everywhere …

The National: Dubai's Amanat Holdings plans to list its education platform

https://www.thenationalnews.com/business/markets/2024/07/18/dubais-amanat-holdings-plans-to-list-its-education-platform/

September seems to be the month, so far …

gfma: Bond market expects half-point Fed rate cut in September. Market speculation is growing around a potential half-point interest rate cut by the Federal Reserve in September, spurred by recent inflation data.

https://www.ft.com/content/c97ce66b-20f9-4289-8eda-4adba833ffa9?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Ammon News: Jordan’s pharmaceutical companies primed to capitalise on regional and international opportunities - looking to expand capital for expansion.

https://www.ammonnews.net/article/862720

If public services in private hands are not up to the job, then this is a remedy …

FT: Labour to begin rail nationalisations within months. Nearly three-quarters of journeys could be on state-controlled lines by July 2025.

https://www.ft.com/content/368283c4-37fb-46af-96f6-4d6b5ea711bf?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

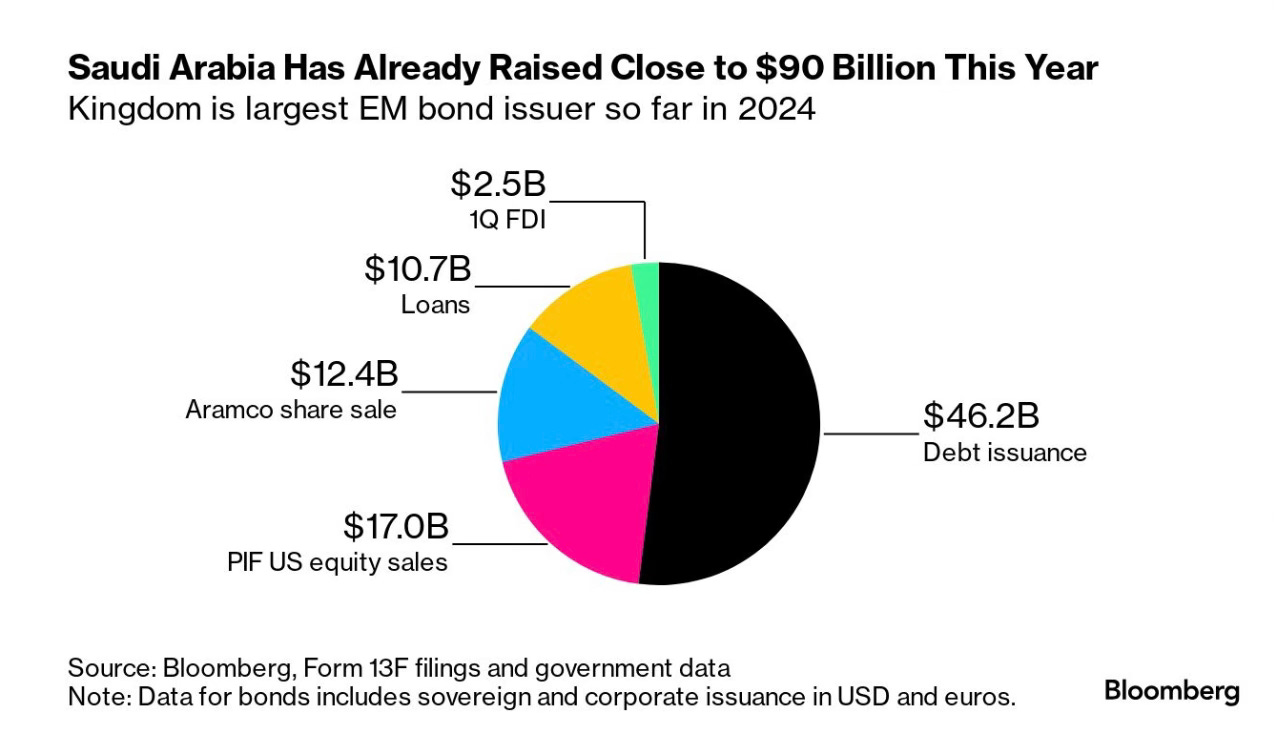

Saudi Arabia debt position is comfortable …

Bloomberg: While the flurry of bond sales creates questions about how much Saudi risk markets can absorb, the kingdom's “second to none in the world” in terms of capacity to bear more debt, Goldman Sachs’ Middle East and North Africa economist Farouk Soussa told Jennifer Zabasajja on Bloomberg TV. “From a balance sheet position, we are extremely relaxed,” he said, pointing to the kingdom’s 30% debt to GDP ratio and large foreign exchange reserves.

No discrimination, please …

Mondo Visione: UK Financial Conduct Authority Calls On Firms To Improve Treatment Of Politically Exposed Persons (PEPs)

https://mondovisione.com/media-and-resources/news/uk-financial-conduct-authority-calls-on-firms-to-improve-treatment-of-politicall?disablemobileredirect=true

What to do with all that debt …

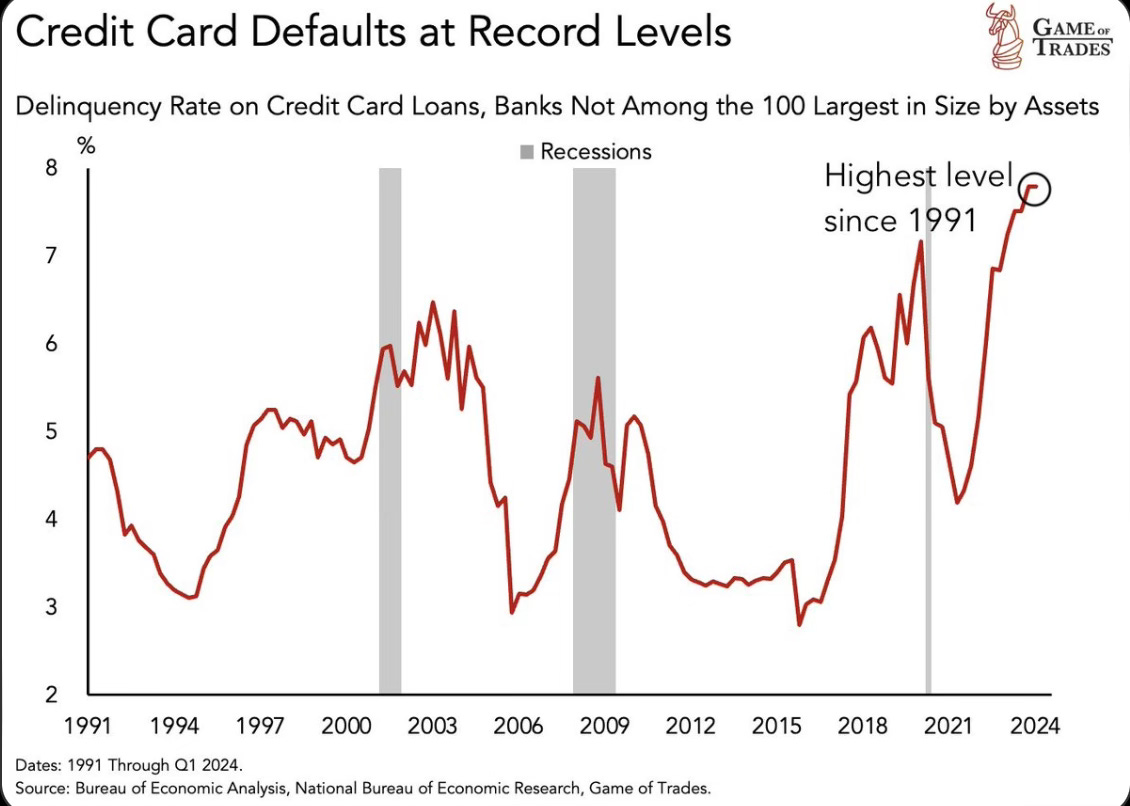

Game of Trades: Credit card defaults from small lenders hit RECORD highs. Crossing even the Dot Com bubble & Financial Crisis peaks. Consumers are nearing trouble.

Mideast IPOs continue …

John Lothian News: Saudi Wealth Fund Picks JPMorgan, Morgan Stanley for Nupco IPO; Nupco is Saudi Arabia's largest medical procurement firm; The PIF could raise close to $1 billion by selling 30% stake

Julia Fioretti, Nicolas Parasie, and Matthew Martin - Bloomberg. /jlne.ws/3LkV7ie

Zawya: GCC IPOs raise $3.6bln in H1; Saudi markets spearhead growth. This represented an increase of 141% in the value of Saudi IPOs compared to H1-2023.

https://www.zawya.com/en/markets/equities/gcc-ipos-raise-36bln-in-h1-saudi-markets-spearhead-growth-wu2xjz5x

Coal consumption is on the rise and African infrastructure needs funding …

John Lothian News: Botswana Eyes New Export Route to Exploit Huge Coal Resource

Borges Nhamire, Matthew Hill and Mbongeni Mguni - Bloomberg

Three southern African nations signed a deal to proceed with a rail and port project to help land-locked Botswana export its massive coal reserves through Mozambique, although they still need to find the money to make it happen. The African Development Bank has agreed to finance a feasibility study for the project, at a cost of about $4 million, Mateus Magala, Mozambique's transport and communications minister, said Friday at a signing ceremony broadcast over state television. /jlne.ws/3W71b2P

The Circuit: Germany’s Henkel, maker of Pert shampoo and a wide range of other beauty products, opened a new factory on Sunday in Riyadh.

Football is content and content is king …

The Circuit: Qatari channel beIN Sports and the U.K.’s DAZN have acquired the TV rights to French football's top-flight Ligue 1 for at least the next two seasons, paying close to $540 million.

It is not just software failures …

Damian Carrington on X: Climate crisis is making days longer, study finds. Melting of ice is slowing planet’s rotation and could disrupt internet traffic, financial transactions and GPS.

https://www.theguardian.com/environment/article/2024/jul/15/climate-crisis-making-days-longer-study?CMP=Share_iOSApp_Other

The Circuit: Chinese Cloth: China’s Zhejiang Hengsheng Dyeing and Finishing Co. broke ground on Sunday for its new $70 million factory in Egypt’s Suez Canal Economic Zone.

The world needs better cables as well as cooling down climate change …

John Lothian News: The World's Power Grids Are Failing as the Planet Warms; Outages from Albania to Texas show how electricity networks aren't ready for climate change.

Eamon Farhat, Misha Savic, Fiona MacDonald, and Mark Chediak - Bloomberg

Under the blazing Adriatic sun, life almost stopped in Montenegro's capital Podgorica earlier this summer. Cars and buses were stuck in gridlock as traffic lights went out, the internet crashed, and security alarms blared in reaction to a sudden loss of power supply. "After one hour without electricity, we were on the verge of panic because it was getting unbearable," said Drago Martinovic, a 61-year-old retired police officer. "I'm afraid it could last longer if it happens again." /jlne.ws/3xVnqAK

John Lothian News: Iraq in Talks With US Treasury Over Banks, Dollar Restrictions

Khalid Al-Ansary - Bloomberg

Iraq has engaged in discussions in Washington with representatives from the US Treasury to address dollar restriction issues, Iraqi Foreign Minister Fuad Hussein said during a press conference aired on state-run media al-Iraqiya. Describing the meetings as "very useful," Hussein indicated that they would continue. Topics slated for upcoming discussions include further talks on the list of Iraqi banks under US sanctions and the status of accumulated Iranian funds in Iraq. "There are serious steps to resolve these issues," Hussein said. /jlne.ws/3Y69s9I

Infrastructure investing …

John Lothian News: Cold Storage Firm Lineage Seeks Up to $3.85 Billion in US IPO; REIT offering 47 million IPO shares for $70 to $82 each; Firm could have a market value of as much as $19.2 billion

Amy Or and Bailey Lipschultz - Bloomberg

Temperature-controlled storage and logistics giant Lineage Inc. is seeking to raise as much as $3.85 billion in its initial public offering. Novi, Michigan-based Lineage is offering 47 million shares for $70 to $82 each, according to a filing with the US Securities and Exchange Commission confirming an earlier Bloomberg News report. The listing could give the real estate investment trust a market value of about $19.2 billion, according to Bloomberg calculations. /jlne.ws/3S8Zxwg

John Lothian News: China Solar Firms, Saudis to Build $3 Billion Worth of Projects

Foster Wong - Bloomberg

Two Chinese solar firms signed deals worth some $3 billion to build plants in Saudi Arabia, highlighting the oil-rich kingdom's campaign to boost renewable power production. TCL Zhonghuan Renewable Energy Technology Co., the world's second-largest maker of solar wafers, said on Tuesday it would partner with the Saudi sovereign wealth fund Public Investment Fund and Vision Industries Co. on a $2.08 billion plant. /jlne.ws/3WlQVF4

Alquds: Iraq issues tender for expansion and operation of Baghdad Airport

https://www.alquds.co.uk/طرح-مناقصة-لاختيار-شركة-خاصة-لتوسعة-وت/

The global competition for minerals …

John Lothian News: London mining Spac plots spree in copper M&A after $300mn Turkey deal; Former Rusal executive Artem Volynets plans to roll up international assets of the vital metal

Harry Dempsey - Financial Times

A mining group led by a former executive at Russia's largest aluminium company is seeking to buy copper miners and establish a leading producer of the metal, after agreeing an inaugural $300mn deal for a Turkish mine. Artem Volynets, chief executive of ACG, who used to be chief of EN+ and head of strategy at Russia's Rusal, told the Financial Times that he plans to roll up copper mines across Africa and North and South America into his London-listed special purpose acquisition company. The intention is to reach up to 300,000 tonnes of annual production by 2027, more than 1 per cent of global annual demand. The ACG's Turkish deal and Volynets' comments come as a spot of bright news for the London Stock Exchange, which has experienced a hollowing out of medium-sized mining companies worth between £200mn and £5bn over the past decade. /jlne.ws/4dagNtn

John Lothian News: Namibia Gets Ready to Become the World's Newest Oil Hotspot

Paul Burkhardt -Bloomberg. /jlne.ws/3LtjB8V

Vertical farming on the rise in the Middle East, including in Mafraq (Jordan) …

Finimize: US vertical farming startup Plenty is joining forces with Mawarid, a subsidiary of Alpha Dhabi Holding, in a massive $680 million deal to boost indoor farming in the Middle East.

https://finimize.com/content/us-vertical-farming-startup-teams-up-for-680m-middle-east-expansion

International Intrigue: The IMF has upgraded its 2024 economic outlook for India, forecasting 7% growth (up slightly from April) and solidifying its reputation as the world’s fastest-growing major economy. However, the IMF is warning of slower growth ahead as India bumps up against a lacklustre regional economic outlook.

Baker McKenzie: Which sectors are hotspots for India inbound M&A and FDI?

https://www.bakermckenzie.com/en/insight/publications/2024/07/sectors-hotspots-india

gfma: China's economic slowdown intensifies in Q2

China's economy grew by 4.7% in Q2, the slowest in five quarters, missing the 5.1% forecast. Retail sales and new home prices fell, reflecting weak consumer confidence despite government efforts. Chinese stocks fell after the disappointing data, with the Hang Seng China Enterprises Index falling as much as 1.7% before erasing some losses.

Red Sea shipping woes impacting global trade …

Defence and Security Forum: Denmark's A.P. Moller-Maersk said that disruption to its container shipping via the Red Sea had extended beyond trade routes between the Far East and Europe to its entire global network. Shipping groups have diverted vessels around Africa's Cape of Good Hope since last December to avoid attacks by Iran-aligned Houthi militants in the Red Sea, with the longer voyage times pushing freight rates higher. Reuters

Climate change was a contributing factor to the Arab Spring in 2012 …

Defence and Security Forum: CMEC PODCAST: CLIMATE CHANGE & THE NEXT GENERATION IN MENA

In the latest podcast of series with the British Council, CMEC Director Charlotte Leslie talks to Amr Ramadan, a climate change young advocate and activist from Egypt who has been working with thew British Council. Amr talks about his work in tackling this enormous challenge. His own city of Alexandria is one of the cities facing the threat of climate-changed induced rising sea levels. Of all the threats we face, climate change is perhaps the greatest and most urgent. Record temperatures are now the norm, and a recent survey of many of the world's leading climate scientists showed that most of them expected temperatures to rise to at least 2. 5 degrees above pre industrial levels. That's far in excess of the 1. 5 degrees rise the world had hoped to keep under. Meanwhile, our attention is drawn by war in Gaza and Ukraine, and elections at home and in the US.

https://cmec.org.uk/insights-analysis/podcasts/podcast-climate-change-and-next-generation-mena?mc_cid=25b10c9d3c&mc_eid=be17c39838&mc_cid=d97f611f50&mc_eid=65c64f36dd

Alquds: Uzbekistan, 3rd largest producer of silk in world

https://www.alquds.co.uk/أوزبكستان-تسعى-إلى-تجديد-صناعة-الحرير/

International Intrigue: Emirates Airlines, a UAE carrier, is holding talks with China this week aimed at expanding its presence and flight routes. Currently the airline operates 35 flights per week into China, a figure Emirates is “hopeful” will grow after this week’s dialogue.

Simon Kuestenmacher on X:

The Medieval Scholar on X: The Return of the Crusader by German painter Karl Friedrich Lessing in 1835.

Bloomberg in 2022: FIFA bans fans from Dressing as Crusaders at England versus USA March

After fantasizing the Crusades in so many works of history, literature and art, many in the West continue to misperceive how the Crusades are viewed in Arab and Muslim lands. In his The Crusades Through Arab Eyes, Amin Maalouf tries to strike a balanced approach, but we all have a long way to go to lay that past to rest...

All the best

Majd