Finally … how will this impact Middle East economies ?

International Intrigue: Fed cuts rates by half a point. The US Federal Reserve has announced its much-anticipated interest rate cut and signalled more to come. It’s the Fed’s first cut in over four years, and the half-point move is in line with what we foreshadowed on Tuesday.

Arab stock markets are coming of age …

Economy Middle East: The market cap of Arab stock exchanges rose 0.52 percent to $4.268 trillion in August 2024, from $4.246 trillion at the end of July 2024, according to the latest release from the Arab Monetary Fund.

https://economymiddleeast.com/news/arab-stock-exchanges-market-cap-grows-0-52-percent-to-4-268-trillion-in-august/

An important (albeit late) warning from the ECB …

FT: World economy faces pressures similar to 1920s slump, warns Christine Lagarde. ECB president highlights parallels between two eras but says modern central bankers have tools to manage structural change.

https://www.ft.com/content/33a44142-3b60-49c5-89d9-2f27b5c30b7f?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Back in 1999 I was a consultant to USAID Jordan and I proposed a project to create a legislative space for Jordanian companies to seek creditor protection a la the US Chapter 11. USAID adopted the initiative and a first draft of a restructuring law was prepared by myself and two lawyers from Jordan and the US. Glad the initiative finally became reality, albeit with important missing parts.

Jordan’s version of the US Chapter 11 allows 40 companies to apply for creditor protection since 2018

Alghad: https://alghad.com/Section-181/اقتصاد/40-شركة-متعثرة-تلجأ-للإعسار-خلال-6-سنوات-تجنبا-للتصفية-1814201

Infrastructure investing is a big part of the future …

S&P: Private markets are actively contributing to the supply of capital funding the infrastructure projects of the future, today.

https://www.spglobal.com/ratings/en/research-insights/private-markets/project-finance-infrastructure

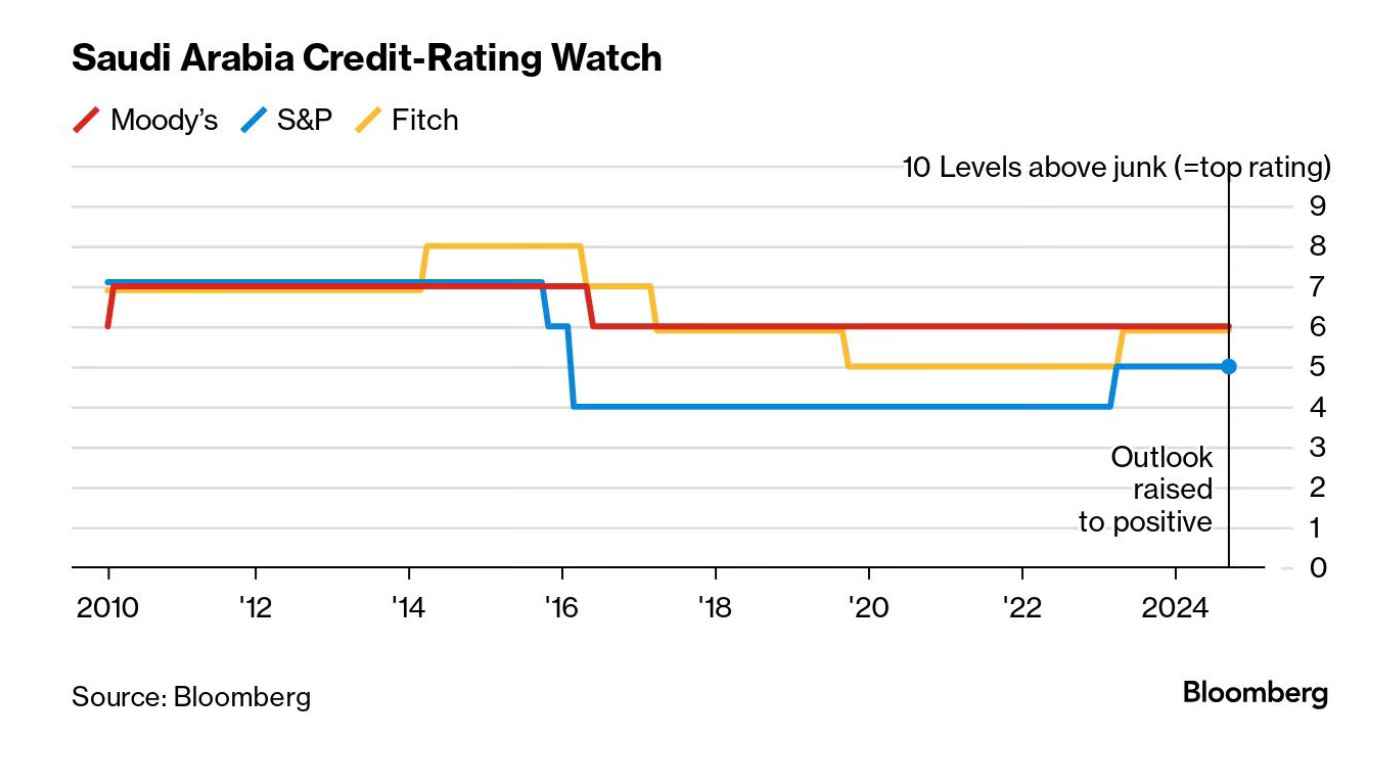

Well done Saudi Arabia …

Bloomberg: S&P raised Saudi Arabia’s outlook to positive from stable and flagged the possibility for future ratings increases.

Climate change is causing havoc everywhere …. what companies should you be investing in ?

Bloomberg: World’s Most Desperately Needed Airplane Is Back in Production. Manufacturer De Havilland Aircraft of Canada is rapidly bringing a water-bombing aircraft back into production as orders have surged due to raging wildfires fueled by climate change.

https://www.bloomberg.com/news/features/2024-09-13/canada-is-making-the-world-s-most-desperately-needed-airplane?cmpid=BBD091624_MIDEAST&utm_medium=email&utm_source=newsletter&utm_term=240916&utm_campaign=middleeast

John Lothian News: Rising Floodwaters Leave Europe Bracing for More Destruction

Andrea Dudik, Natalia Ojewska, Marton Eder and Krystof Chamonikolas - Bloomberg

Deadly floods unleashed destruction across central Europe, with water levels on the River Danube rising further. The torrential rain from Storm Boris is set to subside on Tuesday but water levels remain elevated across the region. In Austria, the focus is turning to the threat posed by melting snow and landslides, after the slow-moving cold weather system brought heavy falls to the Alps. /jlne.ws/3Bbqr17

John Lothian News: Africa Floods Spread Misery Where 55 Million Already Face Hunger; In Mali alone, an area the size of Austria is under water; The number of the needy is likely to surge in coming months

Antony Sguazzin and Katarina Hoije - Bloomberg

The worst floods in decades across a swath of West and Central Africa are deepening a record food-insecurity crisis in a region where the United Nations says 55 million people are already going hungry. While aid agencies and governments are rushing to feed and shelter millions of displaced people, they're struggling to meet the scale of the disaster. There are more food insecure people in the conflict-wracked region with some of the world's poorest countries than the entire population of South Korea. /jlne.ws/3MQ37bE

ETFs of all kind are coming to the Middle East, and in a big way. Watch this space …

The Circuit:

Abu Dhabi-based investment firm Lunate, backed by ADQ, has introduced a new exchange-traded fund, the Chimera S&P Germany UCITS ETF, that tracks the top 30 most liquid publicly traded companies in Germany and will be listed on the Abu Dhabi Securities Exchange.

Saudi Arabia’s first exchange traded funds, or ETFs, investing in Hong Kong’s equities market, will be listed on Riyadh’s Tadawul stock exchange before the end of the year, the Financial Times reports.

Mondo Visione: ETFGI Reports Assets Invested In The Global ETFs Industry Reached A New Record High Of 13.99 Trillion US Dollars At The End Of August

https://mondovisione.com/media-and-resources/news/etfgi-reports-assets-invested-in-the-global-etfs-industry-reached-a-new-record-h-2?disablemobileredirect=true

Beneficial ownership is a big issue in MENA. If you own a company in the US, you are required to abide by these rules.

Mondo Visione: The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) has issued another resource to familiarize small business owners with beneficial ownership reporting requirements. These reporting requirements are mandated by the Corporate Transparency Act, a bipartisan law enacted to curb illicit finance by supporting law enforcement efforts. This law requires many small businesses to report basic information to the Federal government about the real people who ultimately own or control them.

https://mondovisione.com/media-and-resources/news/fincen-publishes-beneficial-ownership-reporting-outreach-and-education-toolkit?disablemobileredirect=true

The increasingly important role of cyber security in MENA …

John Lothian News: FBI says it has disrupted major Chinese hacking operation that threatened US critical infrastructure

Sean Lyngaasn - CNN

The FBI has used a court order to seize control of a network of hundreds of thousands of hacked internet routers and other devices that Chinese government-linked hackers were using to threaten critical infrastructure in the US and overseas, FBI Director Christopher Wray said Wednesday. "It is just one round in a much longer fight," Wray said in a speech at the Aspen Cyber Summit in Washington, DC. "The Chinese government is going to continue to target your organizations and our critical infrastructure." /jlne.ws/3ZwntOB

Indeed, as they should … but a healthy capital market scene nonetheless …

Enterprise: Investors in the Middle East's equity capital markets are becoming more selective as the region experiences a surge in transactions, EFG Hermes’ co-CEO of investment banking, Mohamed Ebeid, told Bloomberg “There continues to be decent demand for ECM [transactions], but investors will become a little bit more selective.”

The region has seen 31 ECM transactions worth USD 18.2 bn this year, surpassing last year's USD 11 bn, according to the news outlet. However, recent IPOs, like Saudi’s Fakeeh Hospital and Abu Dhabi’s Alef Education, showed weaker debuts, highlighting a more selective approach amid tightening liquidity in GCC markets.

Government entities are now stepping in to support local equity funds, who are usually offered more allocations in regional transactions, according to Ebeid.

An IPO of note …

The Circuit: Abu Dhabi's flagship Etihad Airways plans to launch an IPO in 2025 aimed at making the UAE's capital a global travel hub, Reuters reports.

Can this be used by farmers in the arid lands of the Middle East and North Africa ?

John Lothian News: Combining Solar Power With Farming Is Getting Easier. Developers Are Wary of Added Costs; Agrivoltaics may help farms use less water and protect fruit from frost, but many U.S. farmers can still make more money renting their land to developers

H. Claire Brown - The Wall Street Journal

As solar farms fan out across the landscape, some worry they will displace actual farmland. The solution: Why not grow food and produce solar energy on the same plot? Boosted by solar industry support and government funding, researchers are exploring new ways to combine agriculture and solar power. In Ohio, operations have begun on a large-scale U.S. farm producing both crops and solar energy, one of the first of its kind. /jlne.ws/3TCY6am

Well done, UAE …

Business - Standard: UAE makes women on board mandatory for private joint-stock cos from 2025

https://www.business-standard.com/world-news/uae-makes-women-on-board-mandatory-for-private-joint-stock-cos-from-2025-124091800902_1.html

Data centres are part of the future of technology …

The Circuit: The UAE is teaming up with Microsoft, Nvidia and BlackRock to build data centers with the enormous heft to develop artificial intelligence technology and establish guardrails to protect trade secrets from leaking.

The financial partnership, which BlackRock is launching with its new infrastructure investment unit, Global Infrastructure Partners, would be one of the biggest investment vehicles ever raised on Wall Street, the Financial Times reports.

International Intrigue: Google has suspended plans to develop a major $200M data centre in Chile amid environmental concerns. The tech giant obtained building permits in 2020 but quickly found itself tied up with the Chilean court system as locals worried the centre would pull from Chile’s water resources.

Why is Europe neglecting this important sector ?

John Lothian News: Europe's great battery hope Northvolt fights for survival; Swedish start-up struggles to secure funds as it tries to increase production at its gigafactory

Richard Milne - Financial Times. /jlne.ws/3B4r8Jm

There is money to be made in changing money …

The Circuit: As Saudi Arabia opens its doors wider to international tourism, visitors have discovered that it pays to keep some riyals in their wallets, The Circuit’s Omnia Desoukie reports. That’s an opportunity that Travelex, the U.K.-based currency exchange firm, couldn’t miss out on. Travelex CEO Richard Wazacz tells The National his company is intrigued by the opportunity of dotting the kingdom’s airports with his company's currency booths.

Axel Springer is content and content is king …

NYT DealBook: The publishing giant Axel Springer agrees to break up. The company struck a deal to hand a majority stake in its classified ad business to its biggest investors, KKR and CPP Investments, and to retain control over properties including Politico and Business Insider. The transaction, which values all of Axel Springer at $15 billion, will free its C.E.O., Mathias Döpfner, to acquire more media outlets while cutting KKR’s ties to Axel Springer, a relationship that has sometimes come under scrutiny.

MENA investors diversify into Europe …

The Circuit: Qatar Investment Authority: The Qatari sovereign wealth fund is considering raising its 8.8% stake in Spanish power company Iberdrola, Expansion reports.

Infrastructure investing is an asset class …

The Circuit: Abu Dhabi Investment Authority: GIP Aurea, a Singapore-based joint venture between Global Infrastructure Partners and ADIA, has bid on a 30% stake of Malaysia Airports Holdings.

Now, that is an interesting concept …

NYT DealBook: Elon Musk said that SpaceX would sue the F.A.A. for “regulatory overreach” after the agency accused his rocket company of violating spacecraft launch rules. (Axios)

China and Asia …

International Intrigue: Malaysia: At the invitation of President Xi Jinping, Malaysia's king is visiting China […], a first for any Malaysian monarch in a decade. While it’s a largely ceremonial role, King Sultan Ibrahim has occasionally weighed in on substantive issues since taking over the rotating role back in January.

This special dividend basically says that the company does not have enough feasible investments to plow its cash into …

International Intrigue: Microsoft announces stock buyback program. The tech giant has unveiled a $60B stock buyback scheme, while also declaring a 10% increase in quarterly dividends. Microsoft’s shares have gained 15% this year as it continues to lean heavily into AI.

The global competition for minerals …

NYT DealBook: Why investors including Bill Gates and Andreessen Horowitz are rushing to buy a piece of Kobold, a start-up that uses artificial intelligence to identify mining sites. (WSJ)

Turkey enters Africa in more ways than one …

International Intrigue: The Turkish parliament has approved the deployment of the country’s armed forces on a two-year counterterrorism assignment to Somalia. Turkey has been building its presence in Somalia over the past decade, and will soon run an oil and gas exploration mission off Somalia’s coast.

UAE free trade agreements with multiple countries …

The Circuit: The UAE and Japan have started formal negotiations on a free trade pact known as a Comprehensive Economic Partnership Agreement.

International Intrigue: Canberra has announced a new trade deal with the UAE, paving the way for the Emiratis to remove tariffs on about 99% of Australian products. The deal, set to go into force later this year, will also see more Emirati investment into Australia’s critical minerals sector.

Asia’s geopolitical winds and the US election …

International Intrigue: The US and South Korea are reportedly in talks to renew their cost-sharing agreement for US troops in South Korea as officials on both sides of the Pacific prepare for a possible Trump 2.0 presidency. During his first administration, Trump argued Seoul should pay up to 400% more for the US to maintain its ~28,500 troops on the Peninsula.

Non bank lenders should consolidate and list on public markets …

International Intrigue: India: The subcontinent just recorded its biggest IPO this year after India’s top non-bank lender floated its housing finance arm. The listing comes after India’s central bank exhorted a group of non-bank lenders to go public to enhance financial transparency.

Private equity investing in the Middle East down so far this year …

Economy Middle East: Private equity investments in the Middle East and North Africa (MENA) region reached $5.9 billion during the first half of 2024, according to the latest report by PitchBook. This figure is equivalent to around 38 percent of the total deal value in 2023.

https://economymiddleeast.com/news/mena-private-equity-investments-hit-5-9-billion-in-h1-2024-report/

Interesting …

NYT DealBook: BP put Wind Energy, its onshore wind business in the U.S. that is valued at up to $2 billion, up for sale as it looks to shed underperforming renewables divisions. (FT)

Saudi banks ascending …

Arab News: Saudi banks aggregate profit before zakat and tax reached an all time high of SR7.83 billion ($2.1 billion) in July, marking an annual 23 percent rise, newly released data has revealed. According to the Kingdom’s central bank, from January to the end of July, the financial institutions reported total profits of SR50.22 billion, up 13 percent from SR44.5 billion during the same period last year.

https://www.arabnews.com/node/2571227/business-economy

Well done, Saudi Arabia ! This is how it should be …

Arab News: Saudi Arabia’s Capital Market Authority has unveiled a plan for 2024-2026 to develop a robust debt market and enhance the international competitiveness of its asset management industry. The strategy emphasizes safeguarding investors’ rights by increasing transparency and ensuring market integrity. It revolves around three main pillars and includes over 40 initiatives aimed at boosting market growth and efficiency. A key aspect of this approach is enhancing the stock market’s role in capital raising.

https://www.arabnews.com/node/2571465/business-economy

How will this impact banks in the Middle East issuing AT1s ?

gfma: AT1 bond regulatory scrutiny intensifies. Regulators are increasingly scrutinizing AT1 bonds, with the Australian Prudential Regulation Authority was the latest to make a case against them, while others have expressed concerns. Despite these pressures, investors and bankers argue that AT1s help wind up troubled banks smoothly and are a cheaper alternative to equity capital. They propose incremental changes, such as tweaking coupon cancellation rules, to avoid a complete overhaul. Full Story: Risk (subscription required) (16 Sep.)

Africa rising …

John Lothian News: A $90 Billion World Bank Plan to Electrify Africa Gets Underway; Mission 300 aims to bring electricity to 300 million Africans; Rockefeller Foundation, GEAPP to help assess proposed projects

Antony Sguazzin - Bloomberg. /jlne.ws/3MPwBqh

Africa and the Middle East …

John Lothian News: Qatar Eyed as LNG Supplier to Prevent South Africa's Gas Cliff; State power utility Eskom, Sasol seek to aggregate supply; Nation faces gas-supply 'emergency' that puts jobs at stake

Paul Burkhardt - Bloomberg. /jlne.ws/3Zzi5dE

The global competition for minerals …

John Lothian News: Canada opens new critical minerals hub in push to end China's dominance; Saskatchewan facility marks small step in drive to challenge Beijing's control of processing rare earths

Ilya Gridneff - Financial Times

Saskatchewan, a global breadbasket and a world-leading producer of potash and uranium, is set to add another dimension to its strategic importance in the great resources competition between the US and China: rare earths processing. North America's latest rare earth processing centre opens in the city of Saskatoon this week, part of an effort to counter China's global dominance in the supply of the critical minerals needed for the green technology, defence and aerospace industries. The Saskatchewan Research Council, a 75-year-old government-funded scientific research and development institute, has built the commercial venture that will process rare earth minerals from Australia, Brazil and Vietnam until large-scale Canadian mines are operating. /jlne.ws/47Q1ggV

Crisis Group on X: The Islamic State Somalia may have limited reach on the ground, but its fundraising capacity has given it outsized influence within the Islamic State’s broader African network.

https://www.crisisgroup.org/africa/horn-africa/somalia/islamic-state-somalia-responding-evolving-threat?utm_source=http%3A//t.co/&utm_medium=social

Voice of America on X: US General: Chad agrees to bring back US forces

https://www.voanews.com/a/us-general-chad-agrees-to-bring-back-us-forces-/7791656.html

International Intrigue: Mali junta hiding true extent of jihadist attacks. A major attack on the capital by an al Qaeda-linked group earlier this week might’ve killed 100 or more people, significantly more than Mali’s ruling junta has let on. It’s all fuelling doubts about the junta’s ability to deal with the country’s jihadist insurgencies.

International Intrigue: Ecuador: President Daniel Noboa has announced he’ll seek constitutional changes to allow foreign military bases in Ecuador, arguing its international armed gangs need an international response. The US used to have a base in Manabí, but it closed after a former president changed Ecuador’s constitution in 2008 to ban foreign bases.

I would make this study mandatory across all schools and universities in the world …

Boniuk Institute on X: Why is it important to study religious pluralism? We posed this question to a variety of scholars at this year's Spring Convening. Watch this video to hear their insightful answers and thoughts on next steps:

https://t.co/Bd4ApAqNJt

Best of Philosophy on X: "As you start to walk on the way, the way appears.”

Rumi

All the best

Majd