Saturday's Notes of Interest

Mideast stock markets are in acquisitive mode ...

Content is king …

Yahoo Finance: Saudi sovereign investment fund PIF buys into Middle East’s biggest broadcaster, MBC. MBC shares surged 10% in Saudi Arabia after PIF buys majority stake in the company from the government for about $2 billion.

https://uk.finance.yahoo.com/news/middle-east-top-broadcaster-jumps-083901597.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAI1i8pHquxsSRnT37QLnUrkrUt8_UxletJAEnCzmvokxvO-1pynWPoYs4O1npRIG__LoXzuI96fhOTwEM7VZQLge6Mzu7LhXCj5Oep4vVsjSu1sEzNx6Tw5Nikm_LjkNLuuz7nYtMnZA5xp5zkbmxbjx6kli_Ge1sOiu42Xgj-Yo

AML getting increased attention everywhere …

John Lothian News: Singapore Publishes National Anti-Money Laundering Strategy.

Singapore today published its National Anti-Money Laundering (AML) Strategy, as part of continuing efforts to maintain the effectiveness of our AML framework. The National AML Strategy[1] outlines our strategic approach to address money laundering (ML) risks, and guides our risk-targeted actions to combat ML amidst rapidly changing risks and criminal typologies. jlne.ws/4efv9ZC

Education is big business in the Middle East …

WAYA: Edafa Venture Capital (Egypt) has acquired a 25% stake in Bonyan (Saudi), a platform focused on teaching programming to children, aiming to drive innovation in digital education across the Arab region.

https://waya.media/saudi-edafa-venture-capital-secures-25-stake-in-bonyan-platform/

A tale of two banks …

DealBook: Banks reported better-than-expected earnings. Bank of America, Citigroup, Goldman Sachs and JPMorgan Chase reported a combined $6.5 billion in investment banking fees for last quarter, up 27 percent from a year earlier. Smaller players like PNC and Charles Schwab also had a strong showing, appearing to have moved on from last year’s regional banking crisis.

Barchart on X: FDIC warns that 66 banks face the possibility of insolvency after being added to its problem list. https://t.co/XN71kvFHlJ

We need more ETFs in the Middle East …

Medium: SBI Global Asset Management establishes “SBI Saudi Arabia Equity Exchange Traded Fund” has been listed on the Tokyo Stock Exchange (TSE).

https://medium.com/tokyo-fintech/sbi-launched-saudi-arabia-etf-and-partners-for-bim-capital-jv-9160ae932aa8

Water stress is already here …

John Lothian News: Human activity has disrupted the global water cycle for the first time in human history, creating a growing crisis that threatens economies, food production, and lives, according to a report by the Global Commission on the Economics of Water, CNN reported. The combination of poor land and water management, along with the climate crisis, has placed unprecedented stress on the system that moves water around the Earth. Nearly 3 billion people already face water scarcity. The crisis is compounded by increased water demand, as people require around 4,000 liters per day for a dignified life-far more than most regions can provide sustainably.

Saudi exchange SME market segment is booming …

Zawya: SNB Capital has launched the SNB Capital Saudi Nomu Market Fund, providing retail investors with access to the Nomu parallel market. The Saudi Nomu market has historically delivered exceptional performance, listing more than 80 new companies over the last three years and delivering a more than 48% Compound Annual Growth rate over 2019-2024 – outperforming the Main Market (TASI) by almost 40% over the same period.

https://www.zawya.com/en/press-release/companies-news/new-snb-capital-fund-eases-investor-access-to-nomu-parallel-market-osdqury3

The global competition for minerals …

John Lothian News: EU set to choose firm for critical minerals joint buying platform

Eric Onstad - Reuters

The European Union, rushing to develop a 9 million euro joint purchasing mechanism for critical minerals and energy, is choosing between eight bidders vying to develop a platform, documents showed and sources with direct knowledge told Reuters. The bloc's rationale for pooling together buying orders is that it would hand participants more leverage to achieve more favourable deals and prices for critical minerals essential for the green transition that trade in thin and opaque markets often dominated by China. /jlne.ws/48e0kD6

Well done !

Reuters: S&P upgrades Turkey's ratings to 'BB-' in second raise this year

https://www.reuters.com/world/middle-east/sp-upgrades-turkeys-ratings-bb-second-raise-this-year-2024-11-01/

Climate change is impacting family finances …

John Lothian News: Climate-Fueled Extreme Weather Is Hiking up Car Insurance Rates; Home insurers have raised premiums after extreme weather events.

Kiley Price - Inside Climate News

As climate change accelerates, hurricanes, wildfires and hail storms pound the U.S. with growing vigor-and the insurance market is struggling to foot the bill of the damages they leave behind for customers. In 2023 alone, extreme weather cost the U.S. more than $92 billion. And it's not just home insurance providers that are hiking rates. /jlne.ws/3NIfPtD

Heads up …

Zawya: Carlyle Group sold its majority holdings in Tunisia-focused oil and gas producer Mazarine Energy to the company's CEO Edward van Kersbergen. Carlyle invested in Mazarine in 2016. Private equity firm Ramphastos will also sell its stake in Mazarine.

https://www.zawya.com/en/capital-markets/m-a/carlyle-sells-holding-in-tunisia-focused-mazarine-energy-to-ceo-oksuf6sm

A sign of the times …

DealBook: Canada ordered operations of TikTok to close in the country because of national security concerns. (NYT)

International Intrigue: Australia to ban social media for under 16s. The government will soon introduce new legislation aiming to ban children under 16 from social media platforms to safeguard their mental health and safety. Meta (Facebook and Instagram) has pushed back, saying this should be for parents to decide, and that app stores (rather than the apps themselves) should be responsible for verifying a user’s age.

SME access to finance in the Middle East is at the top of everyone’s agenda …

MENA’s Digital News: Z Capital Group (ZCG), USA-HQ private merchant bank, announced that it has expanded to the MENA region through establishing a HQ in Riyadh. It is also allocating $1B for direct lending to small and medium-sized enterprises (SMEs) in Saudi, through its core private equity, private credit, and infrastructure strategies, as a first step of a planned $2B fund

https://finance.yahoo.com/news/zcg-strengthens-global-expansion-commitment-130500777.html

Climate change is already here …

DealBook: This year is likely to be the hottest on record, and could be the first in which global temperatures consistently top 1.5 degrees Celsius over preindustrial levels, a zone at which experts said could lead to irreversible damage to Earth. (NYT)

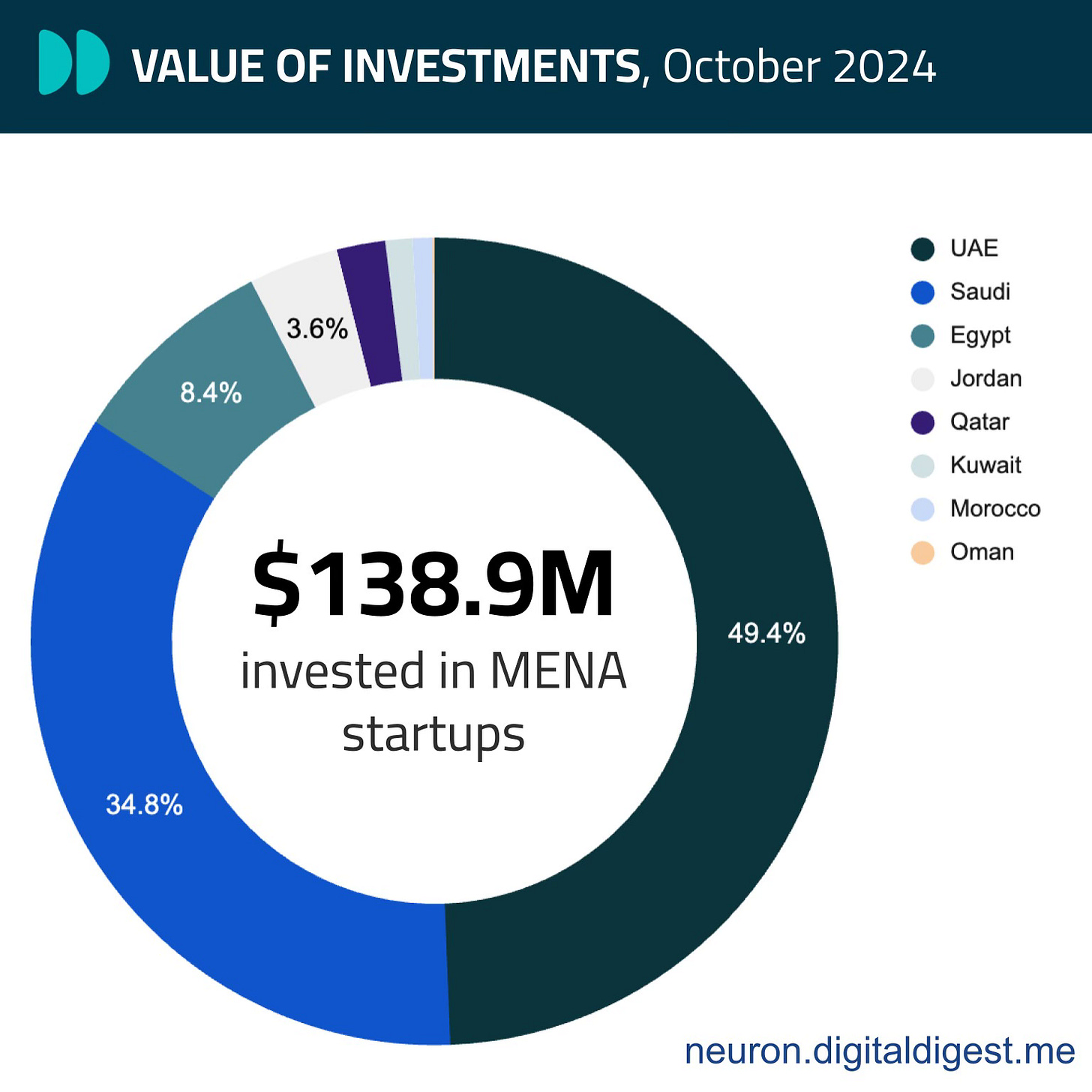

MENA’s startups continue to attract investors from everywhere …

MENA’s Digital News:

Corporate governance standards continue to improve in MENA …

MENA’s Digital News: The Mo Ibrahim Foundation published the ‘2024 Ibrahim Index of African Governance’ report which assesses African countries based on multiple factors including: Security & Rule of Law; Foundations for Economic Opportunity; Human Development; and, Participation, Rights and Inclusion. According to the report, Morocco ranks 8th in Africa and 1st in North Africa on the governance index, followed by Tunisia, 9th, Algeria, 18th. On the Infrastructure improvement sub-category, Morocco ranks the first in Africa, followed by Egypt, and Algeria 4th.

https://mo.ibrahim.foundation/sites/default/files/2024-10/2024-index-report.pdf

Still impressive …

The Circuit: Saudi Aramco said third-quarter profit declined on lower oil prices and weak refining margins. State-owned Aramco, the world’s largest oil company, said it posted a quarterly net profit of $27.6 billion, down from $32.58 billion a year earlier.

The use of market mechanisms to predict political developments …

John Lothian News: Trump Win Boosts Prediction Markets That Nailed Election Outcome; Betting websites that allow wagers on political outcomes had the former president as a heavy favorite leading into Tuesday's vote, even as traditional polls showed a razor-thin margin.

Claire Ballentine, Annie Massa, and Charlie Wells - Bloomberg

For weeks leading up to the contest, prediction websites were cited - and often questioned - for showing the former president as a heavy favorite over Kamala Harris, even as poll after poll pegged it as a toss-up race. In the end, the betting markets won. And with the election seen, particularly in finance circles, as a referendum on the relative power of polls and these platforms, betting websites will now no doubt take on an even greater air of market-powered invincibility. /jlne.ws/4fbbNG6

Heads up …

The Circuit: Libya is planning its first tender for energy exploration contracts since its 2011 civil war.

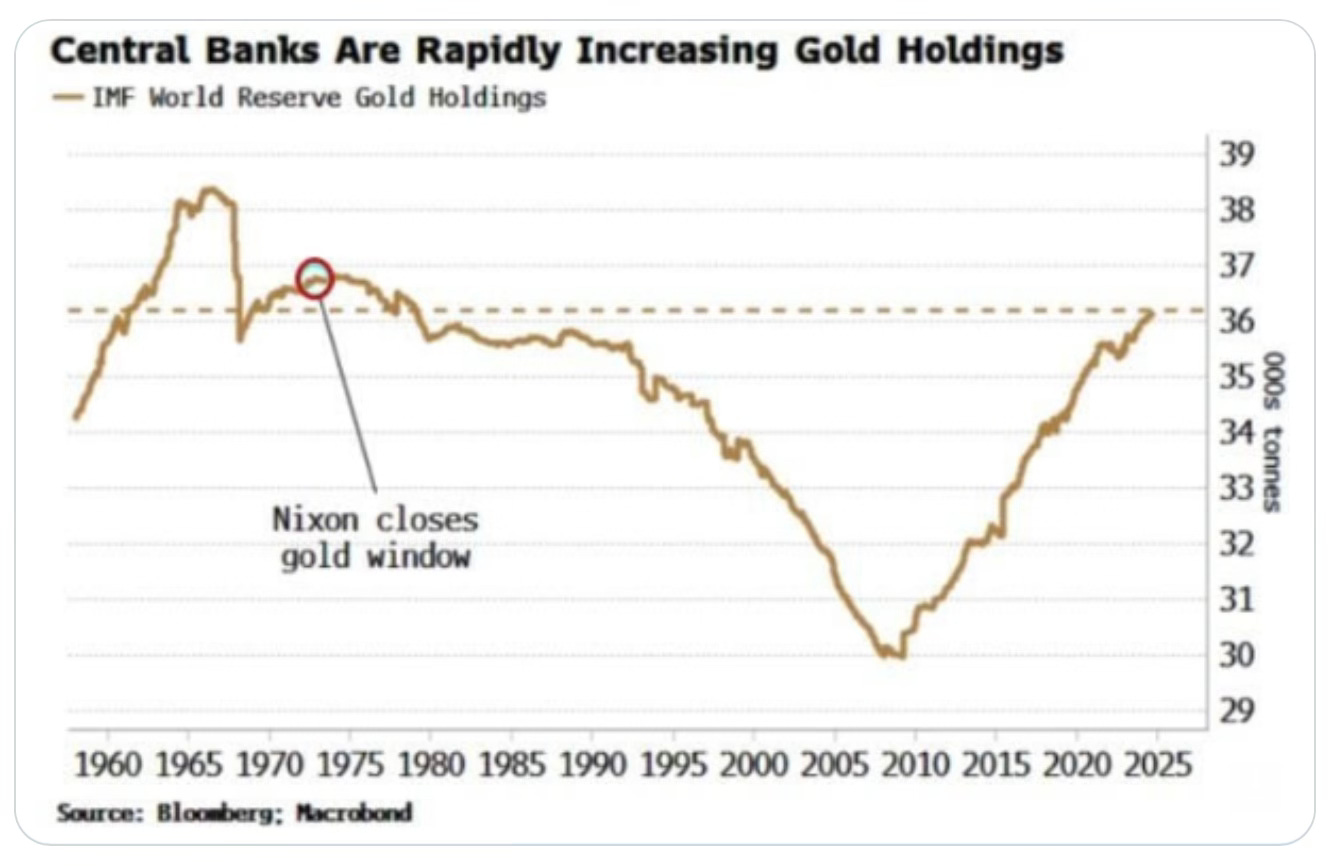

Countries have become less trusting of one another …

Barchart on X: Global Central Banks now hold more than 36,000 tonnes of gold, the most in 45 years.

Still a positive net inflow …

Iridium Advisors: October 2024: GCC equity markets recorded net foreign inflows of $1.2 billion in October, down from the $2.6 billion recorded last month.

The UAE (+$1.8 billion) led regional inflows. Kuwait attracted an inflow of $17 million, while Saudi Arabia (-$277 million) and Qatar (-$216 million) experienced significant outflows.

John Lothian News: Saudi Bourse Plans to Dial Up M&A Amid Capital-Markets Push; Tadawul to focus on 'digestible' acquisitions for time being; Group exploring services like indices, collateral management

Pablo Mayo Cerqueiro - Bloomberg

Saudi Arabia's stock exchange operator is eying mergers and acquisitions as a means to broaden the kingdom's capital markets amid a flood of local offerings, a senior official said. "M&A will play more of a role in our future than it has done in our past," Lee Hodgkinson, chief strategy officer at Saudi Tadawul Group Holding Co., said in an interview in London. The company will aim for "digestible" and "strategically relevant acquisitions," he said, without providing details of any potential targets.

/jlne.ws/4fqlyjw

My take on acquisitive moves by Arab stock markets on Tellimer at link below:

https://www.linkedin.com/posts/duncanwales21_dubai-sells-down-its-nasdaq-investment-the-activity-7176851702216556544-CKta?utm_source=share&utm_medium=member_android

A clear conflict of interest, unless regulated well …

John Lothian News: CME customers criticise futures exchange after it wins approval to also act as broker; Derivatives traders warn of potential 'conflicts of interest' as Chicago group gains licence

Nikou Asgari in London and Jennifer Hughes in New York - Financial Times

Customers of CME Group have strongly criticised the US futures exchange after it was given the green light to become one of their main competitors. Banks and small brokers have sharply criticised the Chicago group after it won approval last week to also act as a futures broker - blurring the traditional dividing line between operating an exchange and being a member of it. "[It] raises serious concerns about market regulation and systemic risk," said Walt Lukken, chief executive of the Futures Industry Association. CME is the world's largest derivatives exchange, handling an average of 28.3mn contracts a day during the third quarter on futures tied to interest rates, Treasuries, energy and equities. /jlne.ws/3YwdXci

Surprised to see the silo model in the US - this has traditionally been a European model …

John Lothian News: CFTC's Mersinger wants new rules for vertical silos; Republican commissioner shares Democrats' concerns about combined FCMs and clearing houses

Janice Kirkel - Risk.net

A change of administration in the White House on November 5 could result in a change of direction at the US Commodity Futures Trading Commission, but on one vexed issue it appears there may be an emerging bipartisan consensus. Whoever runs the CFTC, Republican commissioner Summer Mersinger thinks the agency should prioritise rulemaking that responds to changes in derivatives market structure. "We need to undertake conflicts of interest rulemaking related to what we are calling vertically. /jlne.ws/4fwyGDK

A company of note …

John Lothian News: Australian Explosives Giant Sees Dynamite Opportunity in North America; The CEO expects the region to account for 30%-40% of revenue in the next few years.

Rhiannon Hoyle - The Wall Street Journal

The world's biggest commercial-explosives maker, Australia's Orica, made North America the centerpiece of a recent global buying spree that has included eight acquisitions in four years. As a result, North America-Orica's second-largest market after Australia-should account for between 30% and 40% of the company's revenue within the next few years, said Chief Executive Sanjeev Gandhi. In the first half of Orica's 2024 fiscal year, the region accounted for 22%. Orica's acquisitive run has been part of a strategy to grow beyond its core blasting business. The $5.5 billion company wants to be bigger in specialty chemicals and digital technologies that can help miners recover metals, like those needed to make batteries, more efficiently.

/jlne.ws/3C9ltSP

Interesting development …

John Lothian News: China Plans to Sell Dollar Bonds in Saudi Arabia as Ties Deepen; MOF to sell $2 billion sovereign bonds in Riyadh next week; China may tap dollar bond market again next year: Creditsights

Bloomberg News

China is planning to sell dollar bonds in Saudi Arabia next week, its first debt issuance in the US currency since 2021. The Ministry of Finance will sell up to $2 billion of notes in the week of Nov. 11 in Riyadh, it said in a statement on Tuesday. It last sold dollar bonds in October 2021, data compiled by Bloomberg show. China's plan to sell dollar debt in Saudi Arabia may be a part of its effort to boost economic and financial-market ties with the nation. /jlne.ws/3CdAXFr

John Lothian News: Foreign investors fear India's stock market boom may be over; International investors pull out more than $10bn from Indian stocks as indices record largest fall since March 2020

Chris Kay in Mumbai, Joseph Cotterill in London and Arjun Neil Alim in Hong Kong - Financial Times

Foreign investors pulled more than $10bn out of Indian stocks in October, the biggest monthly exodus since the start of the coronavirus pandemic, on growing concerns that the market's huge bull run may finally be coming to an end as the economy slows. India's two main share indices last month posted their worst monthly losses since March 2020 while the rupee fell close to a record low against the US dollar, as international interest cools in what was one of the hottest global markets.

/jlne.ws/4eb4UmU

Good moves …

International Intrigue: The US is forgiving $1.1B of outstanding loans to Somalia, erasing around a quarter of the country’s foreign debt. Earlier this year, the Paris Club of mostly wealthy lending nations said it would also waive 99% of the $2B debt Somalia owed its members.

Well done …

Thomas Murray: Morocco: Focusing on Market Initiatives

In Morocco, market infrastructures have advised that there are no current plans to shorten the settlement cycle from T+2 to T+1, as this is not being pushed for by market participants. However, the Autorité Marocaine du Marché des Capitaux (AMMC) is studying the potential impact of shortening the settlement cycle.

Instead, the Moroccan market is focused on other initiatives, such as stabilising Securities Lending and Borrowing (SLB), establishing a Central Counterparty (CCP), and introducing derivatives markets. The Casablanca Stock Exchange is working on two main projects: introducing derivatives markets and a CCP by year-end 2024.

Regulatory bodies in Morocco, including the AMMC, Bank Al-Maghrib (BAM), and the Ministry of Finance & Economy, are also discussing digital assets. Drafting a law to define digital assets is underway, with input from regulators across the globe.

Additionally, cyber security regulations have been implemented by the Direction Generale De La Securite Des Systemes D'Information (DGSSI). These regulations aim to enhance security in Morocco's financial markets.

Great British Tea Party on Facebook:

Agatha Christie enjoying tea on the balcony of the British School of Archaeology in Iraq, Baghdad, 1950s. Christie’s second husband, Sir Max Mallowan was a prominent archaeologist, and Christie spent plenty of time travelling with him and digging up ancient Mesopotamian artefacts.

Image: The Christie Archive Trust.

All the best

Majd