Notes of Interest

Big news of the week: Saudi Arabia's Future Investment Initiative conference that took place in Riyadh

Well done !

JKB: Jordan Kuwait Bank Group reports net profits of JOD 148.4 million for the first nine months of 2024, a substantial increase from JOD 72.1 million during the same period in the previous year.

https://www.jkb.com/en/news/jordan-kuwait-bank-group-reports-net-profits-of-jod-1484-million-for-first-nine-months-of-2024

Jordan’s banking sector doing exceptionally well …

Net profits after taxes for Jordanian banks for 9 months this year …

Record breaking numbers …

Zawya: Arab Bank Group reports net profit of $748.6mln for the first nine months of 2024, compared to $630.3 million for the same period last year.

https://www.zawya.com/en/press-release/companies-news/arab-bank-group-reports-net-profit-of-7486mln-for-the-first-nine-months-of-2024-kdn8u1kh

Sadly, this has been coming …

FT: Lebanon placed on global money-laundering ‘grey list’. Financial Action Task Force decision comes after political inaction and could complicate remittance payments.

https://www.ft.com/content/9b721d62-cef4-42b0-b80e-50b1683a68a6?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Tough years ahead for the global economy …

DealBook: I.M.F. has warned about global slow growth and global debt. The global economy is in decent shape as inflation cools, and Bloomberg Economics forecasts growth of 3 percent. But the I.M.F. said last week that growth is too slow to create enough jobs or service government debt that will surpass $100 trillion, by the end of the year.

John Lothian News: S&P Sees More Sovereign Foreign Debt Defaults Over Next Decade; Higher debt, borrowing costs lead to higher risks of defaults; Sovereigns with rising net external liabilities more at risk

Harry Suhartono - Bloomberg

S&P Global Ratings predicts an increase in foreign-currency debt defaults among sovereign issuers over the next decade, driven by significantly higher debt levels and increased borrowing costs on hard currency obligations. The ratings agency said the sovereigns under review on average spent almost 20% of general government revenues on interest payments in the year leading up to defaulting on foreign-currency debt. These high borrowing costs were a result of factors such as rising inflation, currency devaluation, terms-of-trade shocks, and a large portion of government debt being in foreign currency.

/jlne.ws/4f3wu6l

Abu Dhabi’s Masdar continues to impress …

FT: Masdar outlines plan to be one of world’s biggest renewable energy groups. Abu Dhabi company to continue global investment spree that includes nearly €6.5bn of deals in Spain and Greece this year.

https://www.ft.com/content/1386a3e7-db11-43b6-ad07-900c401a66a3

Kuwait put such regulation sometime ago - if you want to raise money in a country, you have to pay the piper …

CMA: Saudi capital market authority releases consultation paper on regulations for selling private equity funds and international funds to retail investors

https://cma.org.sa/Market/News/pages/CMA_N_3654.aspx

Well done TSX - Brazil’s is a giant of a capital market with massive potential …

John Lothian News: Toronto Stock Exchange and B3 Sign Memorandum of Understanding

TMX

TMX Group's equity exchanges, Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV), and B3 (Brazil Stock Exchange), today announced the signing of a non-binding Memorandum of Understanding (MoU), where TSX/TSXV and B3 agree to create more public market opportunities for investors and entrepreneurs to help power the Brazilian markets. Under the scope of the MoU, TSX/TSXV and B3 will explore a Brazil-based solution that builds on Canadian expertise around mining, energy and renewable energy industries, among other things. The project's intention is to join efforts to build an ecosystem that may facilitate the dual listing of mineral research companies based in Brazil.

/jlne.ws/3YHgORb

Abu Dhabi’s ADNOC continues to impress …

MEED: Abu Dhabi National Oil Company (Adnoc) has completed the transaction to acquire a majority stake in UAE-headquartered Fertiglobe, the largest nitrogen-based fertiliser producer in the Middle East and North Africa region.

https://www.meed.com/adnoc-completes-majority-stake-acquisition-in-fertiglobe/?utm_source=organic&utm_medium=linkedin&utm_campaign=socialmediapost

Maritime transport is on the rise …

Enterprise: The UAE accounts for 2.2% of global maritime transport in 2024 with a fleet size of 1.4k ships and tankers, according to a United Nations Trade and Development Organization report (pdf). The GCC country was ranked 16th in the world in terms of fleet commercial value, accounting for 1.7% of the total global value. It also came in 12th place globally in terms of fleet ownership by capacity in 2024 with a total of 51.3 mn tons.

Energy generation acquires added urgency worldwide …

Javier Blas: Electricity consumption is accelerating faster than renewable sources can provide. And so the world -- or, better said, China and India -- turns to coal.

https://t.co/DJw288wpHu

Heads up !

International Intrigue: Pakistan’s finance minister has said his country is planning to finish privatising its national airline plus outsourcing Islamabad’s international airport next month. He said the cash-raising move, first announced in April, has been delayed to ensure “macroeconomic stability” and “due diligence.”

Several Arab stock markets use a EURONEXT trading system …

John Lothian News: ELITE, the Euronext ecosystem supporting privately-owned small and medium-sized enterprises (SMEs) in their sustainable long-term growth, today launches the ELITE Impact Observatory on the occasion of ELITE Day 2024. The analysis measures the impact of ELITE in terms of financial performance and employment for the companies within the network.

/jlne.ws/482WRal

All sectors of relevance to GCC investors …

The Asset: Taiwan stock exchange woos Middle East investors. TWSE chief leads delegation to Qatar, Saudi Arabia and United Arab Emirates. Taiwan's semiconductor sector, a cornerstone of the global AI supply chain, has positioned Taiwan’s capital market as a focal point for international investors.

https://www.theasset.com/article/52658/taiwan-stock-exchange-woos-middle-east-investors

Be careful !

John Lothian News: Watch Out for This Gmail Account Takeover Scam; Be on the lookout for unexpected Gmail account recovery attempts and subsequent customer service calls that sound a little too perfect, warns IT consultant Sam Mitrovic.

Will McCurdy - PC Mag

Using phony account-recovery notifications is a classic trick used by cybercriminals carrying out phishing attacks, Forbes points out. These types of ploys will generally lead customers to a fake login portal, which will capture their login details.

/jlne.ws/488WlHJ

The Global South beginning to take shape …

Defence and Security Forum: SAUDI ARABIA COMMITS TO BRICS COOPERATION AT PUTIN-HOSTED KAZAN SUMMIT

Saudi Foreign Minister Prince Faisal bin Farhan led the Kingdom’s delegation at the BRICS Plus 2024 Summit in Kazan, Russia on Thursday, on behalf of King Salman. Saudi Arabia has not officially joined the bloc, but participates in its activities as an invited nation.

Algeria is one of 13 countries to join the BRICS bloc and one of 3 African countries to do so. Egypt, Ethiopia, Iran, and the United Arab Emirates joined BRICS earlier this year. Punch (Nigeria)

MENA capital markets on the rise …

Zawya: MENA equity capital markets (ECM) raised $21 billion in equity and equity-related issuances in the first nine months of 2024, boosted by a $12.3 billion stock sale by Saudi Arabia’s Aramco. This marks a 154% increase from year ago levels and the highest first nine-month total in the region since 2008, data from the London Stock Exchange Group (LSEG) showed.

https://www.zawya.com/en/markets/equities/mena-equity-capital-market-issuances-soar-in-nine-months-fueled-by-follow-on-issuances-kskcfu2j

Education is an investment asset class - particularly in the MENA …

DealBook: A group including Neuberger Berman and EQT has invested in Nord Anglia, an operator of international schools, at a valuation of $14.5 billion, including debt. (Bloomberg)

We need more ETFs in MENA …

John Lothian News: Saudi Arabian ETF Tracking Chinese Stocks Raises $1.3 Billion; ETF has raised HK$10 billion, more than any of its local peers; Fund due to be listed on the domestic exchange next week

Bloomberg News

A Saudi Arabian investment firm will soon launch the country's largest exchange traded fund to track Hong Kong-listed Chinese stocks, the latest sign of closer financial ties between China and the oil-rich kingdom. The securities arm of Bank Albilad raised HK$10 billion ($1.3 billion) for its Albilad CSOP MSCI Hong Kong China ETF as of Wednesday, according to the social media account of the fund's Chinese partner. The fund is bigger than any of its peers listed on the Saudi Arabian exchange, according to data compiled by Bloomberg. It will start trading next Wednesday.

/jlne.ws/48m20KX

China deepens MENA economic ties …

PR Newswire: Hong Kong Exchanges and Clearing to open an office in Riyadh in 2025. The new office will strengthen HKEX's Middle East presence as the Group looks to promote greater connectivity between China and the Gulf region, aiming to facilitate new opportunities for its customers and issuers around the world.

https://www.prnewswire.com/news-releases/hkex-to-open-office-in-riyadh-to-expand-middle-east-presence-302291106.html

Bloomberg: Investcorp’s China-Backed Fund Tees Off With Three Mideast Deals

https://www.bnnbloomberg.ca/business/international/2024/10/30/investcorps-china-backed-fund-tees-off-with-three-mideast-deals/

An interesting segmentation …

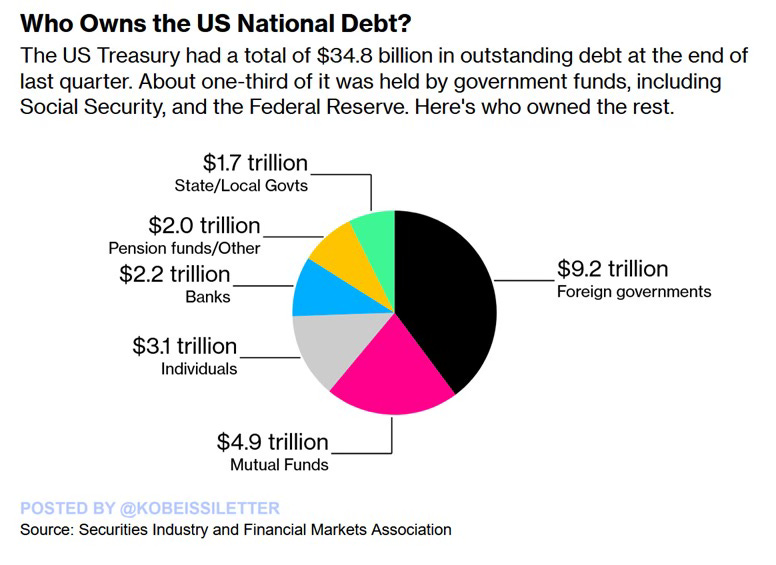

The Kobeissi Letter on X: Who owns all of the US debt? The US Treasury had $34.8 trillion in outstanding debt at the end of Q2 2024, of which ~33% was held by government funds such as Social Security and the Fed.

$9.2 trillion, or ~26%, was owned by foreign governments, with the most held by Japan and subsequently China. $4.9 trillion, or an equivalent of 14%, was in possession of mutual funds and $3.1 trillion by individuals. Banks and pension funds owned $2.2 trillion and $2.0 trillion, respectively.

Meanwhile, US federal debt has jumped $300 billion over the last 3 weeks and hit a new record of $35.8 trillion. We will soon see $40 trillion of US Federal debt.

Short selling is an essential part of viable capital markets …

John Lothian News: Turkey Considers Ending Ban on Short-Selling of Stocks; Fund managers say ban deters inflows by preventing hedges; Ban was tightened last year in wake of twin earthquakes

Kerim Karakaya - Bloomberg

Turkish officials are discussing easing a ban on short-selling of equities in hopes of attracting more overseas inflows, people familiar with the matter said. Turkey imposed the ban early last year after a pair of earthquakes devastated entire regions in the country's southeast. Officials are now considering easing the ban gradually or lifting it completely, but details haven't been finalized and could change…

/jlne.ws/3UlO7GJ

Arab stock markets should look into extending trading hours …

John Lothian News: The New York Stock Exchange is extending trading on its Arca equities venue to 22 hours on weekdays, capitalizing on global demand for US stocks. The largest US stock exchange will offer trading on Arca - one of its main venues - from 1:30 a.m. to 11:30 p.m. eastern time on all weekdays, excluding holidays, it said in a statement Friday. The move, subject to regulatory approval, makes US listed stocks, ETFs and closed-end funds available for trading outside the normal 9:30 a.m. to 4 p.m. window. NYSE said the DTCC will continue to clear all trades in the extended hours.

/jlne.ws/3Uik5Dx

Turkey’s focus on renewables …

DFC on X: The US DFC announces a $350M loan to support 9 wind power plants in Western Türkiye. "This project is a milestone for DFC and a model for accelerating the energy transition," said DCEO Biswal.

https://www.dfc.gov/media/press-releases/dfc-announces-its-largest-wind-energy-investment

Arab stock markets that haven’t done so already should move with corporatising and listing their stock markets …

John Lothian News: India's largest stock exchange is awaiting clearance from the securities regulator to proceed with its public listing plans. The National Stock Exchange of India Ltd., whose initial public offering has faced delays since it initial filing in 2016, needs approval from the Securities and Exchange Board of India to reapply.

/jlne.ws/4e09hkv

Find your country !

The World Bank: Forecasts for 19 Middle East and North Africa countries, country by country …

https://thedocs.worldbank.org/en/doc/65cf93926fdb3ea23b72f277fc249a72-0500042021/related/mpo-mena.pdf

Many retail investors in MENA are using such apps …

John Lothian News: Investment apps: are they up to scratch? Beware the time-consuming lure of gut-reaction trading from your handset

Moira O'Neill - Financial Times (opinion)

A good mobile app has become an important way for asset managers and brokers to give investors a positive experience. Most online investing services offer one and their functionality is much more comprehensive than a few years ago. But there are big variations in these apps. While some investment platforms only offer the basics, others are starting to offer new types of engagement that feels, dare I say it, exciting.

/jlne.ws/40d3gxQ

It goes to tell that economics will always trump politics …

Bloomberg Economics on X: The worst political upheaval in years hasn’t taken the shine off Kenya’s top-performing currency and rallying markets as investors focus on an improving economy and healthy capital inflows.

https://www.bloomberg.com/news/articles/2024-10-24/kesusd-kenya-s-bonds-shilling-stocks-unmoved-by-vice-president-impeachment?utm_campaign=socialflow-organic&utm_source=twitter&utm_content=economics&utm_medium=social&cmpid%3D=socialflow-twitter-economics

A good summation of two types of oil contracts …

John Lothian News: In his October 2024 article for Intercontinental Exchange (ICE), ICE Global Head of Oil Market Research Mike Wittner explains the key differences between ICE Brent and NYMEX WTI futures. Brent is a waterborne global crude benchmark, with flexible logistics and storage options that make it less prone to price volatility, including the negative prices seen with WTI in April 2020. WTI, a landlocked crude stored in Cushing, Oklahoma, faces storage constraints and is more sensitive to regional supply and demand, often leading to more extreme price swings. Brent's global reach, storage capacity, and flexibility make it more stable, offering lower volatility and typically better roll yields compared to WTI.

https://www.ice.com/insights/energy/what-are-the-differences-between-ice-brent-and-nymex-wti-futures

Sharia compliant investing in listed securities is gaining ground worldwide …

John Lothian News: JSE Welcomes Shariah-Compliant, Satrix MSCI World Islamic Feeder ETF

JSE

The ETF is designed to reflect and measure the performance of large- and mid-cap companies across 23 developed markets, ensuring dividends and investments are compliant for Islamic investors. Trading under the code STXWIS, this fund is tailored for investors seeking capital growth, featuring a targeted annual Total Expense Ratio (TER) of 0.55%. It leverages the MSCI World Islamic Index as its benchmark, which is diversified across key sectors such as information technology, energy, healthcare, utilities, and others. Top constituents include Microsoft Corp, Tesla, Exxon Mobil Corp, Procter & Gamble Co, among others.

/jlne.ws/3Yeylys

An ETF in the making ?

The Circuit: The London Stock Exchange’s FTSE Russell and the Abu Dhabi Securities Exchange launched the FTSE ADX 15 Islamic Index (FADXI15), to address growing demand for Shariah-compliant investment products.

https://www.wam.ae/en/article/b5xe3ik-adx-ftse-russell-launch-ftse-adx-islamic-index

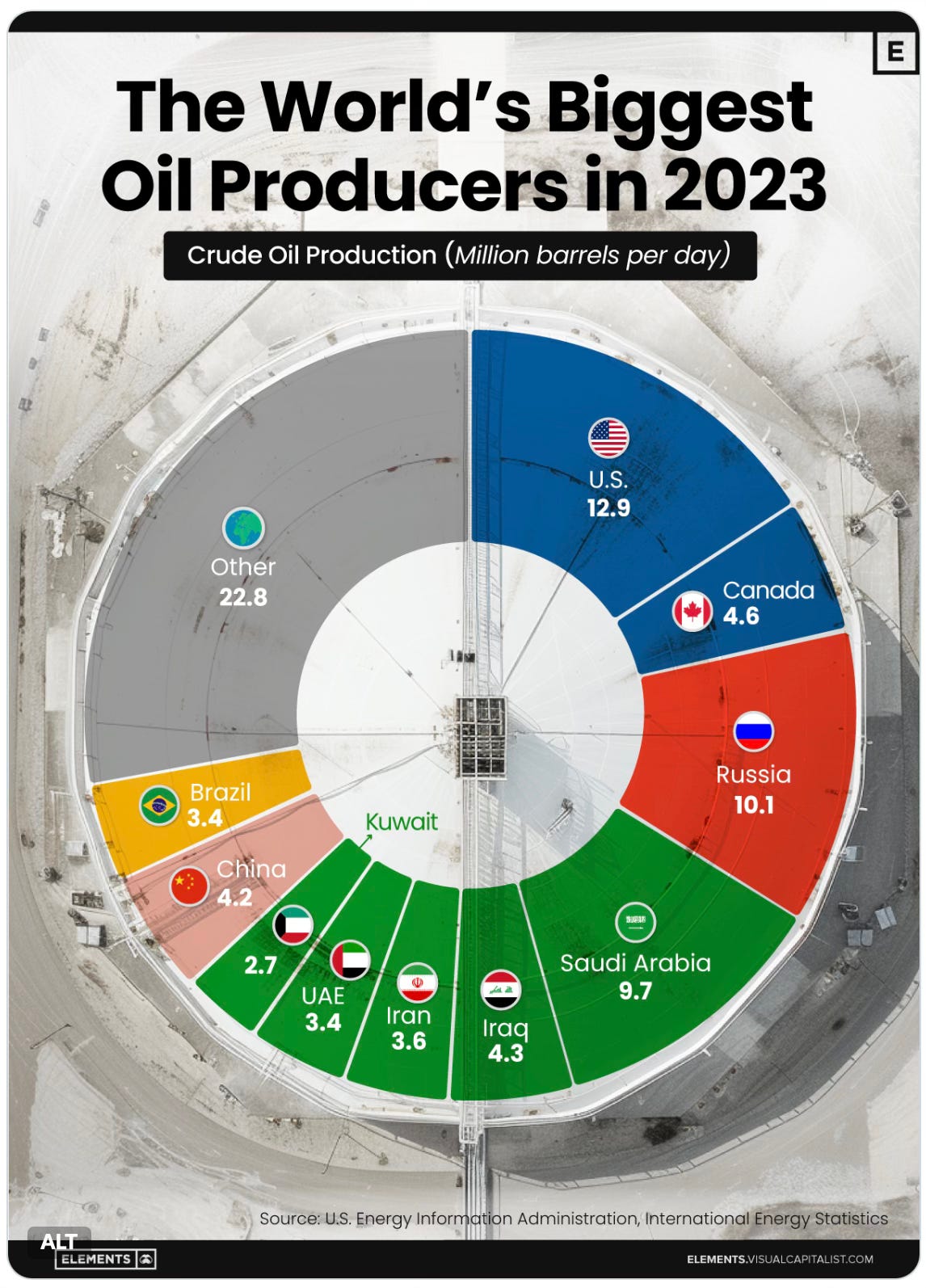

US, Russia, Saudi Arabia …

Civixplorer on X: The world’s biggest oil producers

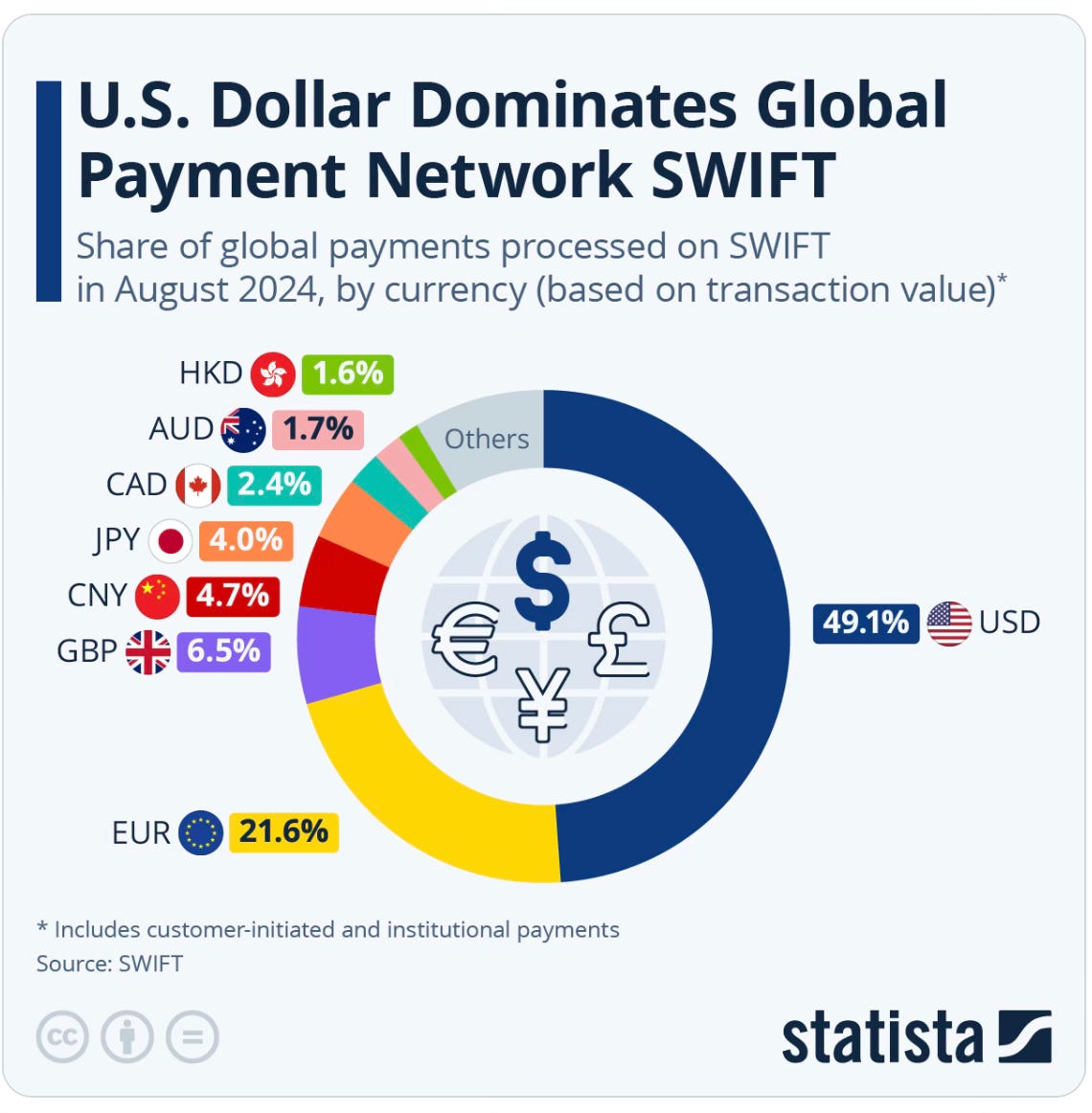

The US dollar will continue to reign supreme but payments in between countries in local currencies will gain ground …

Statista on X: The majority of payments on SWIFT is made in U.S. dollars. In Aug. 2024, the dollar accounted for 49.1% of payments. Excluding payments within the Eurozone, the dollar’s share even climbs to 60% illustrating its role as the closest thing we have to a “world currency”.

I agree …

John Lothian News: Pollution-free environment a 'fundamental right', India's top court says

Sakshi Dayal - Reuters

Living in a pollution-free environment is a fundamental right, India's Supreme Court said on Wednesday as it urged authorities to address deteriorating air quality in the north of the country. India's capital Delhi recorded a "very poor" air quality index of 364 on Wednesday, according to the Central Pollution Control Board, which considers readings below 50 to be good. Swiss group IQAir rated Delhi the world's most polluted city in its live rankings.

/jlne.ws/3NzYT8i

A development of note …

Intelligence Online: Could CMA CGM and ADIT join forces to make Marseille a business diplomacy capital? Corporate intelligence group ADIT is looking to organise a business diplomacy forum in Marseille for interests from both sides of the Mediterranean and the Gulf. It is banking on the support of leading French shipping group CMA CGM, which is based in the French city.

https://www.intelligenceonline.com/international-dealmaking/2024/10/31/could-cma-cgm-and-adit-join-forces-to-make-marseille-a-business-diplomacy-capital%2C110333949-art?cxt=PUB&utm_source=INT&utm_medium=email&utm_campaign=AUTO_EDIT_SOM_PROS&did=91041103

The global competition for minerals …

John Lothian News: Global copper rush draws investors to Argentina's untapped deposits

Ciara Nugent - Financial Times

Accessing the copper at Taca Taca, a deposit of the metal in Argentina's inhospitable north-west, is a gargantuan task. The site's low-grade 0.5 per cent copper ore lies several hundred metres beneath a Mars-like desert of rolling red dunes, volcanoes and salt lakes. It sits 3,600m above sea level and a bumpy seven-hour drive from Salta, the nearest city.

/jlne.ws/3BXFKec

UAE’s stock markets continue to attract international investments …

WAM: Net foreign and institutional investments in equities reached AED25.6 billion during the first ten months of 2024, distributed by AED23 billion in the Abu Dhabi market and AED2.6 billion in the Dubai market.

https://www.wam.ae/article/b5xzj3z-net-foreign-institutional-investments-equities

Cross border payments are big business …

Mondo Visione: BIS And Central Bank Partners Demonstrate That Policy Compliance Can Be Embedded In Cross-border Transactions With Project Mandala. Project Mandala addresses the significant challenges in maintaining compliance with disparate regulatory and policy frameworks across jurisdictions, successfully demonstrates the automation of compliance procedures for cross-border financial transactions. It is a collaboration between the BIS Innovation Hub, the Reserve Bank of Australia, the Bank of Korea, Bank Negara Malaysia and the Monetary Authority of Singapore.

https://mondovisione.com/media-and-resources/news/bis-and-central-bank-partners-demonstrate-that-policy-compliance-can-be-embedded?disablemobileredirect=true

The Circuit: A consortium of 13 Egyptian banks, led by the Commercial International Bank and Banque Misr, will provide Telecom Egypt with a seven-year loan worth $369 million.

Is Bursa Malaysia in a position to acquire another exchange ?

Mondo Visione: Bursa Malaysia Announces Rm241.2 Million (around USD 55 million) Profit After Tax, Zakat And Minority Interest For The Nine Months Ended 30 September 2024

https://mondovisione.com/media-and-resources/news/bursa-malaysia-announces-rm2412-million-profit-after-tax-zakat-and-minority-in?disablemobileredirect=true

Good for Iraq …

The Circuit: Dubai-based Dex Squared Hospitality won a multimillion-dollar contract to develop the World Heart Hotel brand in Iraq and operate Baghdad’s first 5-star luxury hotel.

Morocco continues to impress …

The Circuit: France's Engie and Morocco’s OCP Group signed a preliminary agreement to invest up to $18 billion in desalination, renewable energy, and green hydrogen projects, inking the deal during French President Emmanuel Macron's visit to Rabat.

Heads up !

The Circuit: Kuwait is taking bids to build a new city for 35,000 residents that will comprise more than 22,000 houses, hotels and other facilities at a cost of some $3.3 billion, Al-Qabas reports, predicting that Chinese firms are likely to win many of the contracts.

MENA funds giving domestic investments more attention …

FT: Saudi Arabia’s sovereign wealth fund plans to further scale back the share of its international investment, drawing a line under a multibillion-dollar global spending spree as it refocuses on the domestic economy. The Public Investment Fund, which has about $930bn worth of assets, said it intended to cut the proportion of funds invested overseas to between 18 and 20 per cent, down from 21 per cent today and a high of 30 per cent in 2020.

https://www.ft.com/content/5004fbc6-23e2-4b9f-9885-14e1ea724ce2?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Brining FDI into Saudi and the region …

CNBC: Saudi sovereign wealth fund announces $2 billion deal for new Brookfield Middle East platform. Brookfield Middle East Partners “will target $2 billion from a variety of investors, and intends to target buyouts, structured solutions and other investment opportunities,” the firm said in a statement. While the fund is not limited to Saudi Arabia, at least 50% of the capital will be allocated to investments in the kingdom and to bringing international companies into the local market.

https://www.cnbc.com/2024/10/30/saudi-sovereign-wealth-fund-announces-2-billion-deal-for-new-brookfield-middle-east-platform.html

Conference: Dec. 5-6, Abu Dhabi: Milken Institute Middle East and Africa Summit. Corporate executives, investors, government officials, and philanthropists gather to address the globe’s most pressing issues. St. Regis Saadiyat Island.

https://milkeninstitute.org/events/middle-east-and-africa-summit-2024

All the best

Majd