US China competition arrives in Middle East …

Bloomberg: US Is Slowing AI Chip Exports to Middle East by Nvidia, AMD (2). License requests from chipmakers delayed for policy review. US is worried about the technology getting diverted to China.

https://news.bloomberglaw.com/international-trade/us-is-reining-in-ai-chip-sales-to-middle-east-by-nvidia-amd-1

Major asset price correction taking place in the real estate sector. Will other sectors follow? Are assets overpriced?

Lisa Abramowicz: About $1.7 trillion, or nearly 30% of outstanding commercial real estate debt, is expected to mature from 2024 to 2026. Most of this debt is going to need to reprice during this time at a time when office values have fallen about 34% from the 2021 peak.

https://www.stlouisfed.org/on-the-economy/2024/may/commercial-real-estate-in-focus

John Lothian News: Commercial Property Meltdown Clobbers Pension Funds; Government retirement funds are selling property at a loss as the slump spreads

Heather Gillers - The Wall Street Journal

Government pension plans are getting hit by the commercial real-estate meltdown and many fear the bleeding is far from over. Canada's national pension plan said in May that it is selling stakes in Manhattan and San Francisco office towers for $225 million less than it paid for them. In April, California's government worker pension fund said it had unloaded a Sacramento property it had been trying to develop for almost two decades. In March, consultants warned California's teacher pension that office holdings would continue to drag down returns, even after a 9% real estate loss in 2023. /jlne.ws/3Vnxuva

Morocco stock market introduces derivatives. Great for liquidity and international investors, and listed companies.

EBRD: Derivatives Market: International trends and development prospects in Morocco

https://ebrd.com/news/events/derivatives-market-international-trends-and-development-prospects-in-morocco.html

Renewable energy emerging as an infrastructure asset class …

NYT DealBook: Brookfield, the infrastructure investment giant, is said to be teaming with Singapore’s investment fund Temasek to buy a French wind power developer, Neoen, for $6.6 billion. (FT)

Saudi expanding its global energy presence …

Jennifer Gnana: Saudi Aramco is considering major investments in two US LNG projects (Port Arthur & Rio Grande) in Texas as part of a broader push by the state-owned oil giant to build a global LNG business, according to sources familiar with the matter.

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/lng/053024-saudi-aramco-considers-us-lng-deals-with-rio-grande-port-arthur-export-projects-sources

Give back what was stolen …

Al-Monitor: Iraq recovers over 6,000 stolen historical artifacts

https://www.al-monitor.com/originals/2024/05/iraq-recovers-over-6000-stolen-historical-artifacts-government-says

It is because of economic growth or lack of workers ?

gfma: Eurzone unemployment falls to record low

Unemployment in the eurozone fell to a record low in April, to 6.4% from 6.5% where it had sat since last November. Economists had expected the rate to hold, but the number of unemployed workers fell by around 100,000 from March. European Central Bank economists had expected the unemployment rate to rise to 6.7% this year before falling in 2025, but will release new projections next week. Full Story: The Wall Street

via Francesco Sassi:

This will impact interest rates in Middle Eastern countries with currencies pegged to the US dollar …

Lisa Abramowicz: Japan owns $1.2 trillion of US Treasuries. As Japanese yields rise, the domestic market will attract dollars away from US debt. "Rising long-term interest rates in Japan put upward pressure on long-term US Treasury yields:" Apollo's Torsten Slok

China and the Middle East growing business and investment ties. Lenovo was sold by IBM to China many years ago.

Bloomberg: Saudi Arabia’s plan to invest $2 billion in Lenovo is the latest example of a strategy to use its cash pile to lure foreign companies. In return, the Chinese computer-maker pledged to open a manufacturing facility and establish a regional headquarters in the kingdom.

The global competition for minerals and rare minerals …

John Lothian News: Australia orders Chinese-linked funds to sell rare-earth stakes in 'national interest'; Canberra is trying to create stronger supply chain for critical minerals in the energy transition

Nic Fildes - Financial Times

Australia's government has ordered funds linked to a Chinese businessman to cut their stakes in a rare-earths miner, in a sign of how control of critical minerals is becoming a political concern. Jim Chalmers, Australia's treasurer, cited national interest grounds in demanding that Yuxiao Fund and four associates reduce or dispose of their stakes in Northern Minerals, a Western Australian rare-earths developer. /jlne.ws/3X5n70c

Arab News: Saudi banks’ risk profiles stronger than GCC counterparts: Fitch

https://www.arabnews.com/node/2520151/business-economy

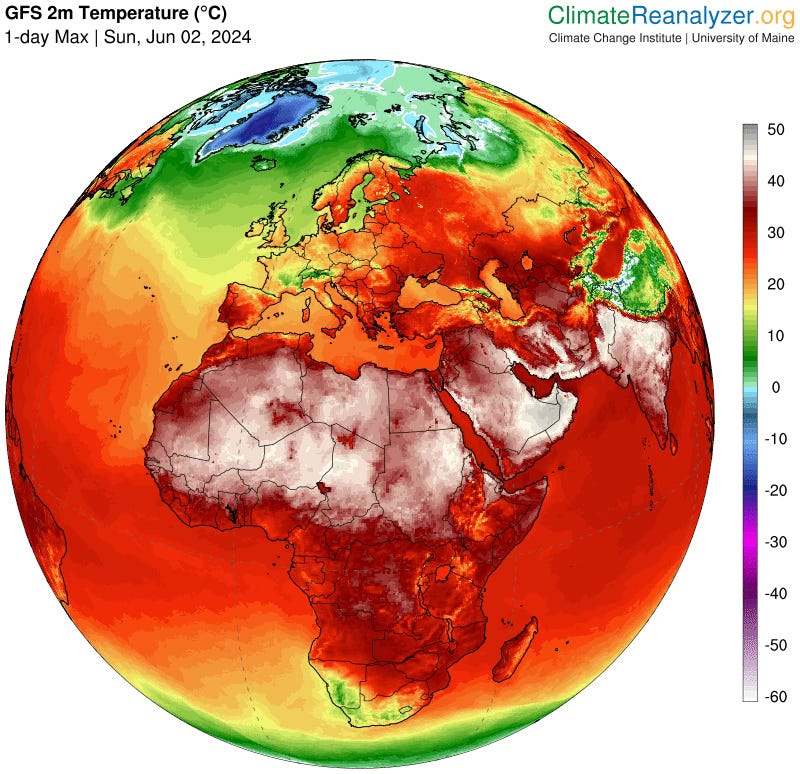

We will soon see waves of migration, internal and cross border, due to unbearable climate conditions …

Peter Dynes: Billions of people are currently surviving in temperatures between 45 and 50C. This is "only" at a 1.5C global increase. At 2C, these regions will become unbearable for long periods of the year. The lack of a coherent plan for this is shocking. Mitigation is urgent.

Central Asian countries extend into the Middle East …

MEES: Adnoc awarded Azerbaijan’s state company Socar a 3% stake in its Sarb & Umm Lulu offshore concession

https://www.mees.com/2024/5/31/news-in-brief/adnoc-awards-azerbaijans-socar-3-stake-in-offshore-concession/23b02170-1f4b-11ef-93aa-c11664775218

Climate affecting safety and the economy …

Colin McCarthy: The Atlantic is in uncharted territory in 2024.

Severe marine heatwave conditions have rapidly developed in the Caribbean, Gulf of Mexico, and off the coast of Florida, with water temperatures already peaking in the low 90s in Florida.

The Florida Keys and the Bahamas are already under a bleaching warning as ocean temperatures are at record-warm levels for late May, leading to accumulating heat stress for coral reefs and marine ecosystems. Water temperatures in some areas are up to 5-8°F above normal

These record hot ocean temperatures across the Atlantic will also provide more fuel for developing hurricanes. More heat in the ocean equates to more energy for hurricanes, exponentially increasing the upper limit and damage potential of hurricanes.

Just a 2°F rise in sea surface temperatures can increase a hurricane's wind speeds by over 13%. This means a 140 mph Category 4 hurricane can become a 160 mph Category 5 (in favorable atmospheric conditions), with nearly 3x the damage potential.

Arab News: How a warming planet threatens the Nile Delta. The densely populated Delta is home to half of Egypt’s population, close to 50 million people. Projections indicate that 25 percent of the Delta could be submerged within a few decades if the current trajectory continues.

https://www.arabnews.com/node/2521556?fbclid=IwZXh0bgNhZW0CMTAAAR1HCjrrUQU6M6-_3zTCCmP2KkjvFDw8k9gJrXHlM2qY_JAiENPmNI1etsw_aem_ARUVlGOjXWDDZh9KXUg3ZykPdFEz1NIJ4oAV9H-sDDvNiUvYY94c5fIeNx6uldtd0aJTEHEgVixFAEHPMX2JUi_X

This will be reflected in higher home prices …

FT: The uninsurable world: how the insurance industry fell behind on climate change. Surge in floods and fires has caught out the insurance industry and added an ‘uncertainty factor’ to premiums

https://www.ft.com/content/b4bf187a-1040-4a28-9f9e-fa8c4603ed1b

Arab News: Google launches Gemini Advanced & Gemini mobile app in Arabic

https://www.arabnews.com/node/2520431/media

A reckoning is on the way for food delivery companies in the Middle East. Delivery Hero has operations in the region.

FT: Food delivery apps rack up $20bn in losses in fierce battle for diners. DoorDash, Deliveroo, Delivery Hero and Just Eat Takeaway put new focus on profits, despite slower growth following the pandemic.

https://www.ft.com/content/675f5c8b-6029-4393-8eba-d6f00327e090

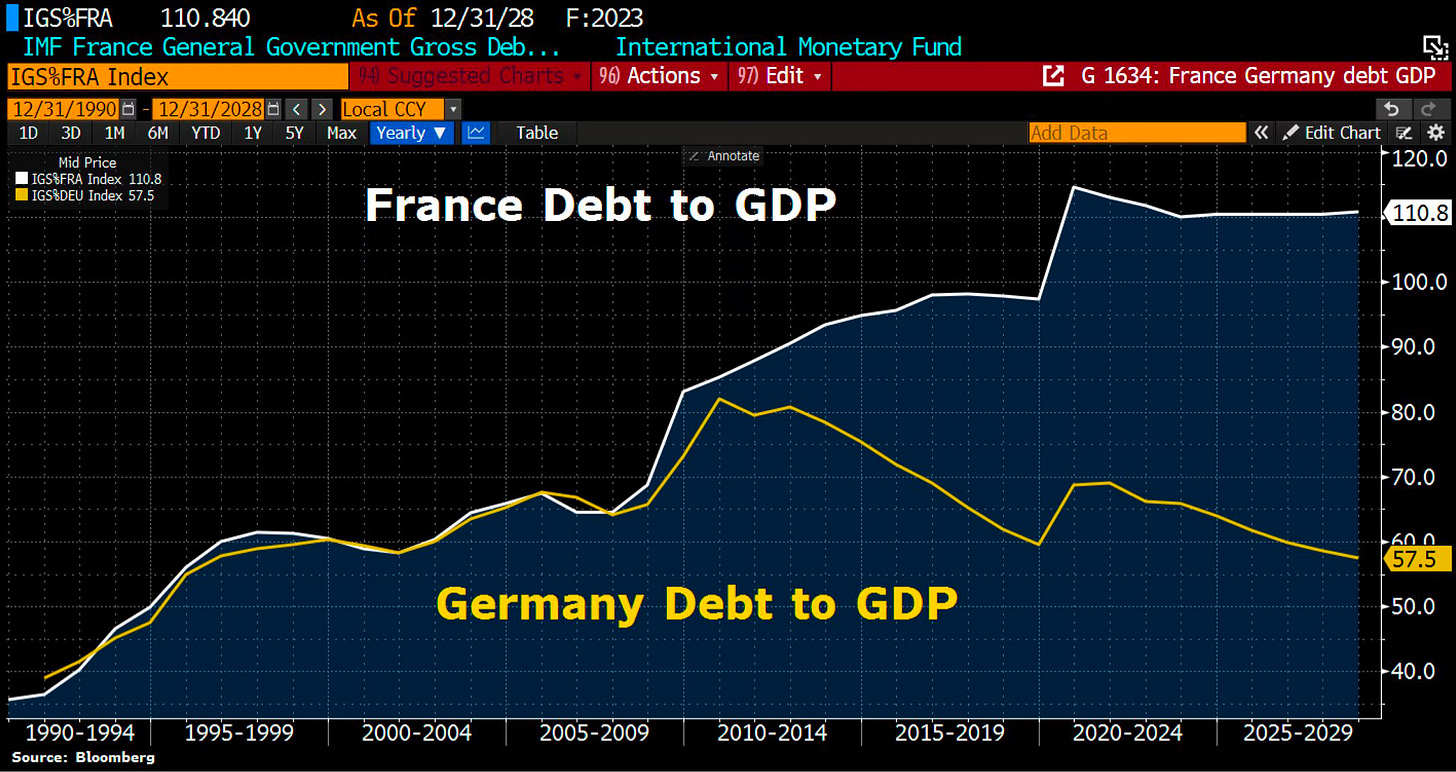

Signs of the times …

FT: Downgrade to French credit rating stings Macron government. S&P warns debt ratios will only worsen in coming years and put Paris’s 2027 target for controlling deficit out of reach.

Fitch Ratings: Fitch Upgrades Saudi Arabia to 'A+'; Outlook Stable

https://www.fitchratings.com/research/sovereigns/fitch-upgrades-saudi-arabia-to-a-outlook-stable-05-04-2023

https://www.ft.com/content/20815670-2a94-4ee5-a013-0f64ccf529fb?desktop=true&segmentId=7c8f09b9-9b61-4fbb-9430-9208a9e233c8#myft:notification:daily-email:content

Arab News: A Chinese spacecraft lands on moon’s far side to collect rocks in growing space rivalry with US

https://www.arabnews.com/node/2521731/world?fbclid=IwZXh0bgNhZW0CMTAAAR1h_YXAfpqo9-8eMF3LADXATPWNzk6DC6pfHEBAyjgjOlzsIubfgl2wEiU_aem_ARUUGgzoGzkUH-ENer8UXv9mm1Gqlhs4mHmw5dLF-ki70E_h3m1_F6I2ikx0UYF_fC82--sHCkauWiFyg8_LJo7s

Alquds: Demonstrations in Algeria due to water supply interruptions

https://www.alquds.co.uk/أزمة-انقطاع-المياه-تدفع-سكان-ولاية-جزا/

The shares were sold within hours. Aramco pays high dividends (around 6) compared to its global peers - an attractive Sharia-compliant investment to many Middle East investors.

FT: Saudi Arabia to sell $12bn worth of Saudi Aramco shares. Offering in world’s largest oil exporter to be set in range of SR26.7-SR29 as kingdom seeks fresh capital.

https://www.ft.com/content/e11fd8b3-ed17-40d9-9ee8-e171df9be558

Corporate cybersecurity requirements in western countries will gradually impact Middle East banks and corporates …

John Lothian News: How the DOJ is using a Civil War-era law to enforce corporate cybersecurity

Eric Geller - The Record

Amid an onslaught of high-profile cyberattacks showing how companies often neglect basic security measures, the Department of Justice is trying to use a law passed during the Civil War to put businesses on notice that these failures are unacceptable. Under the umbrella of DOJ's Civil Cyber-Fraud Initiative, U.S. government attorneys have since early 2022 deployed the pointedly named False Claims Act to punish contractors that mislead the government about their cybersecurity defenses, hoping to send a shot across the bow of other vendors that aren't complying with rules intended to fend off hackers. It's an approach that reflects the goals in President Joe Biden's National Cybersecurity Strategy, which emphasizes holding companies to a higher standard of cybersecurity and shifting the burden of combating hackers from customers to vendors. /jlne.ws/4bFNRJ4

International Intrigue: Kazakhstan: President Toqaev has announced Kazakhstan is removing the Taliban from its terrorist list in an effort to boost trade with Taliban-led Afghanistan. Toqaev is also pushing for a new UN office focused on development and stability across Central Asia.

International Intrigue: Japanese auto giant Toyota has apologised for cheating on a series of crash test and engine power certifications for seven models, halting production of three (the Corolla Fielder, Corolla Axio, and Yaris Cross). Japan’s transport ministry says rivals Honda, Mazda and Suzuki also cheated on some certifications.

A well thought out and wise decision by Kuwait’s Emir

Tellimer: Kuwait's new Crown Prince might unify royal family, reduce political dysfunction

Kuwait's Emir nominated a Crown Prince last week. This matters for two reasons. Firstly, rivalry among different branches of the royal has been one cause of political paralysis and this nomination may bring greater unity.

Climate affecting prices of basic commodities, in more ways than one, and impacting decisions on interest rates in the process. Addressing climate issues cannot be left on a voluntary basis going forward.

John Lothian News: Wheat Jumps Most Since War in Ukraine Due to Weather

Aine Quinn, Olesia Safronova and Celia Bergin - Bloomberg

In April, Ukrainian farmer Yurii Sekh was looking forward to a good wheat harvest. One of the driest Mays in the region's records dashed those hopes. It also sent prices for the staple grain soaring, reviving fears of rising food costs. Russia, which along with Ukraine accounts for almost a third of global wheat exports, has seen parched crops during a vital month for their development. Unseasonal frost also devastated acres of standing crops, and with harvests now only weeks away, the chances of a substantial recovery are dwindling. /jlne.ws/3V4E9ZZ

This will not necessarily mean lower prices …

Arab News: Global LNG supply to increase by 80% by 2030: Goldman Sachs driven by new projects in Qatar and North America.

https://www.arabnews.com/node/2521906/business-economy

Michael A. Arouet:

Given the state of world affairs these days, this is an important discussion. Hats off to SOAS for taking the lead.

Panel discussion: The politics of protest and academic freedom in time of transition, crisis, and war.

SOAS VC Professor Adam Habib will be joined by Lisa Anderson (Columbia University) and Rabab El Mahdi (The American University in Cairo) to discuss how to support these two principles during difficult times. 12 June - 3pm - BGLT / Online

https://www.soas.ac.uk/about/event/politics-protest-and-academic-freedom-time-transition-crisis-and-war

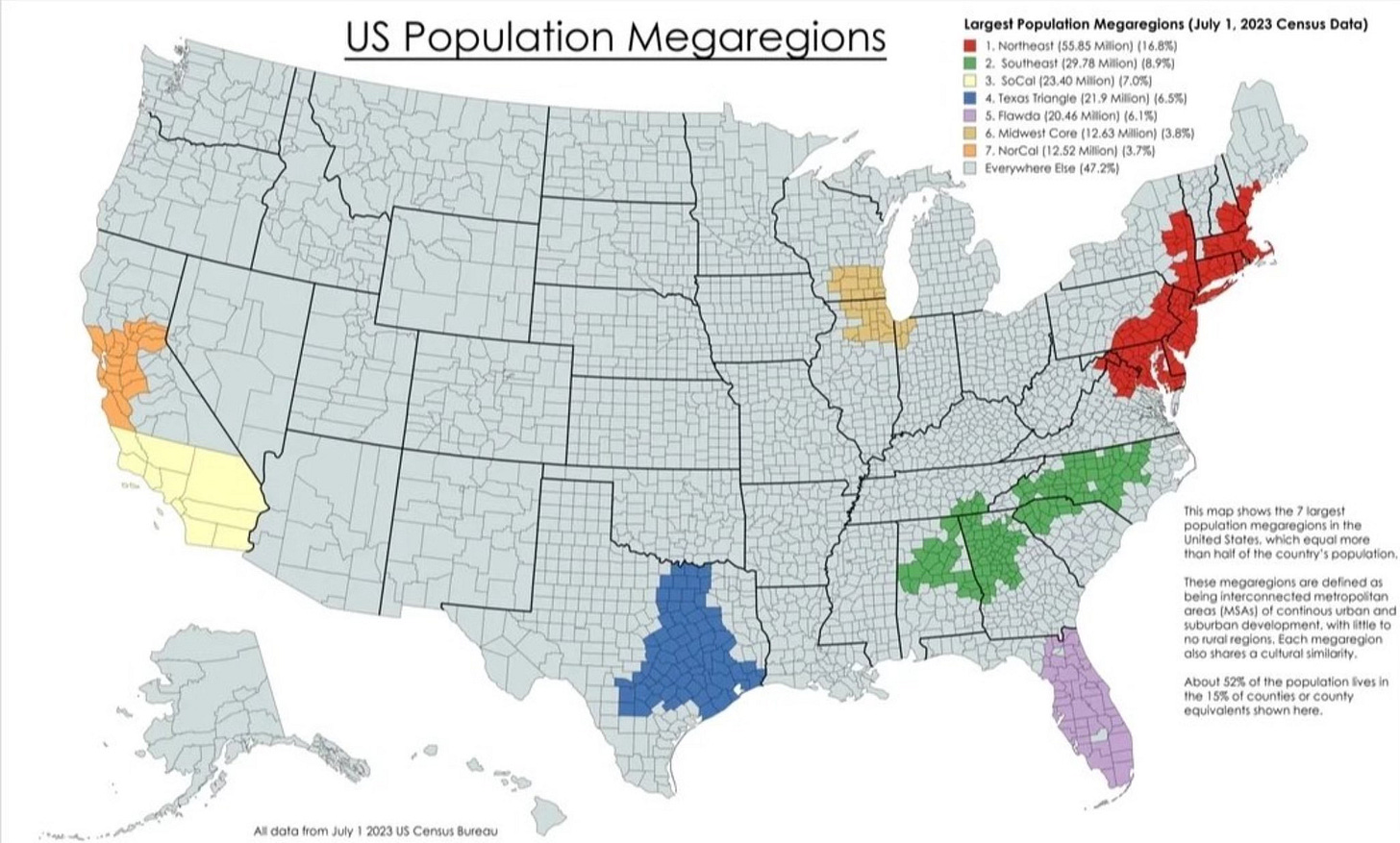

Michael A. Arouet: 52.8% of US population live in these seven areas

China and the Middle East …

via Sada: China’s Burgeoning Halal Trade: Implications for the Arab World

China has expanded its presence in the global halal economy, opening new avenues for Sino-Arab cooperation and competition.

https://carnegieendowment.org/sada/2024/05/chinas-burgeoning-halal-trade-implications-for-the-arab-world?lang=en

Big oil is consolidating globally …

NYT DealBook: ConocoPhillips buys Marathon Oil for $22.5 billion. The deal between the Texas energy companies was the latest in a wave of M.&A. in the sector, as the United States has become the world’s leading oil producer. Hess shareholders also backed Chevron’s $53 billion takeover this week.

Princeton University Press:

Ibn Khaldun (1332–1406) is generally regarded as the greatest intellectual ever to have appeared in the Arab world—a genius who ranks as one of the world’s great minds. Yet the author of the Muqaddima, the most important study of history ever produced in the Islamic world, is not as well known as he should be, and his ideas are widely misunderstood. In this groundbreaking intellectual biography, Robert Irwin provides an engaging and authoritative account of Ibn Khaldun’s extraordinary life, times, writings, and ideas.

Irwin tells how Ibn Khaldun, who lived in a world decimated by the Black Death, held a long series of posts in the tumultuous Islamic courts of North Africa and Muslim Spain, becoming a major political player as well as a teacher and writer. Closely examining the Muqaddima, a startlingly original analysis of the laws of history, and drawing on many other contemporary sources, Irwin shows how Ibn Khaldun’s life and thought fit into historical and intellectual context, including medieval Islamic theology, philosophy, politics, literature, economics, law, and tribal life. Because Ibn Khaldun’s ideas often seem to anticipate by centuries developments in many fields, he has often been depicted as more of a modern man than a medieval one, and Irwin’s account of such misreadings provides new insights about the history of Orientalism.

In contrast, Irwin presents an Ibn Khaldun who was a creature of his time—a devout Sufi mystic who was obsessed with the occult and futurology and who lived in an often-strange world quite different from our own.

MENA Visuals: Che Guevara visiting the tomb of Muslim Kurd Sultan Saladin, Damascus, Syria, 1959.

"...you heard a voice .... that sounded like reason, and there was reason to it, as the most compelling lies are comprised almost entirely of the truth. But that's what it does. Cloaks itself in whatever it must to move you to action. And the more you deny its presence, the more powerful it gets, and the more likely it is to consume you entirely without you ever even knowing it was there."

From Black Sails

All the best

Majd